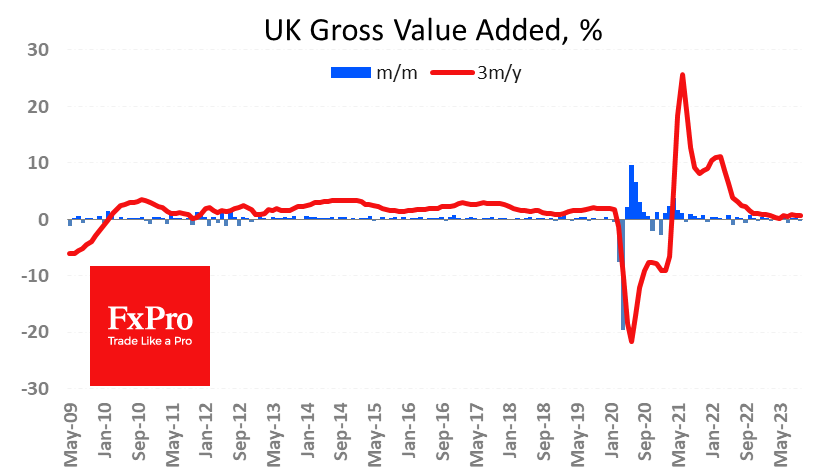

A series of macro statistics continue to be published to help build a picture of the economy ahead of the Bank of England’s final decision on Thursday. The economy is reported to have lost 0.3% for October, pulling back in volume to July levels.

This is a wake-up call from industrial production and construction, which are considered leading indicators of the business cycle. The index of industrial production fell immediately by 0.8% in October (-0.1% was expected), and the nominal index rolled back close to plateau levels from the final quarter of last year. Industrial production is only 0.6% above post-pandemic lows. If we exclude the lockdown period, UK industrial production last saw such a low back in 2017.

High interest rates are putting pressure on the industry. The strengthening of the pound against the euro by 4% and the dollar by 12% over the year is also not helping the economy. The combination of deteriorating global demand and the appreciating pound is suppressing exports, which were 24% lower in October than a year earlier. Imports are also falling in the wake of commodity and energy prices and are now 18% below their peak in August last year, but the year-on-year fall is a modest 6%.

The UK economy needs stimulus in the form of a weaker GBP exchange rate, which would support the country’s global competitiveness and lower interest rates to boost production and domestic consumption. On the other hand, UK prices and wages are rising at the fastest rate among major economies, which prevents the Bank of England from its easing policy.

This combination of factors leaves the Bank of England no choice but to declare the end of the rate hike cycle and dutifully wait for the shrinking economy to bring inflation down to acceptable levels to start the easing policy.

The British pound has a long-standing downward trend against the dollar, dating back to the times of the global financial crisis. In July and recent weeks, GBPUSD has made its way to resistance. Technically, we can see both a breakdown of this multi-year trend and a reversal to growth, as well as the formation of a powerful downward impulse. The latest macroeconomic data package gives more chances for the second – a pessimistic – scenario.

The FxPro Analyst Team