The S&P 500’s pullback after disappointing US employment statistics allowed investors to switch into the buy-the-dip mode. The FOMO strategy continues to dominate the stock market. Major players doubt whether the broad stock index can continue its rally amid the economic slowdown. The crowd is taking advantage of their sluggishness and increasing their long positions. Bulls are counting on the Fed to ease monetary policy, fiscal stimulus, and positive corporate reporting.

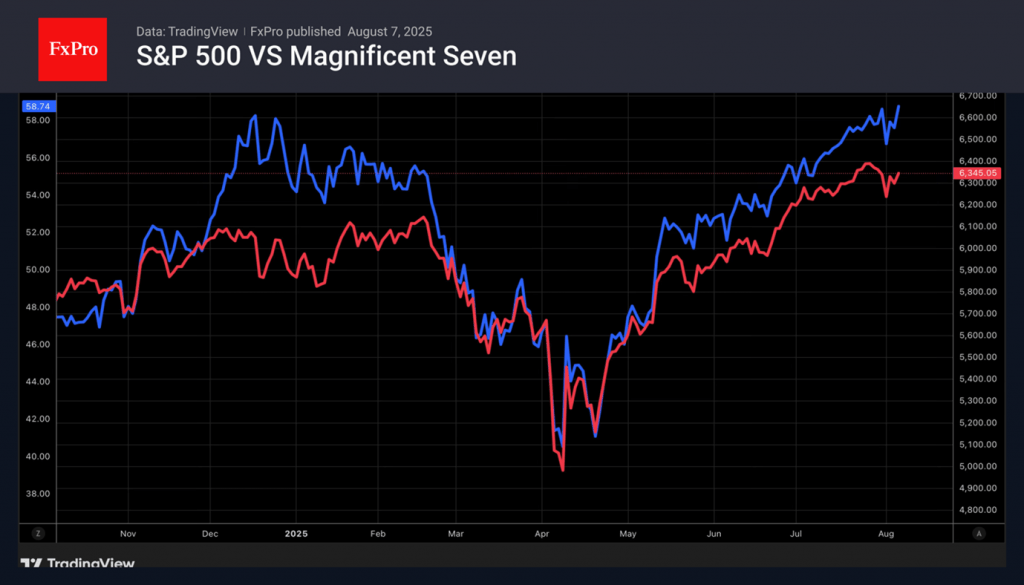

Actual second-quarter results exceeded forecasts by 9.1%, the largest positive deviation since 2021. The Magnificent Seven set the tone, with profits jumping 26%. The rest of the S&P 500 companies achieved more modest growth of 4%.

However, the market continues to send alarming signals. Insiders bought the smallest volume of shares in July since 2018. The market momentum index has reached an extreme. This indicates limited gains for the S&P 500 in the near future. August is a bad month for the broad stock index. Over the past 10 years, it has closed in the red five times.

The FxPro Analyst Team