Market Overview

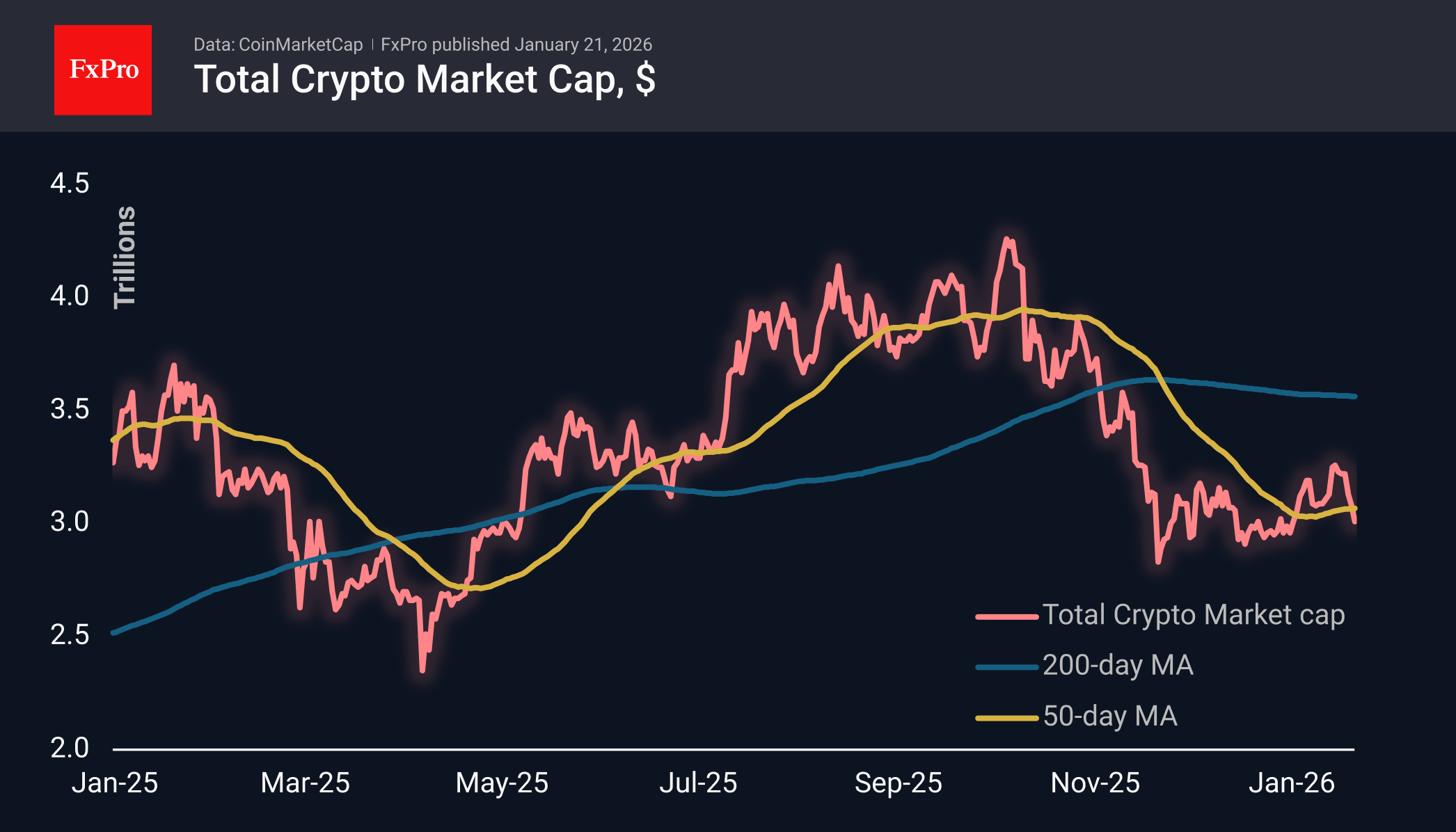

The crypto market capitalisation fell below $3T, slightly exceeding this round level at the start of active trading in Europe, but losing more than 2% in 24 hours. The market is once again below the 50-day moving average, and the growth momentum at the start of the year seems to have fallen through thin ice. The current situation contrasts with last year’s market behaviour, when we saw two dips below this trend line.

There is even more contrast between how Bitcoin is reacting to tariff threats now and in April. In April last year, Bitcoin rose alongside gold on the ‘sell America’ trade. Now, the first cryptocurrency looks even weaker than the stock market, as the S&P 500 has retreated from its high just over a week ago by only 3%. For comparison, BTC’s high was set more than three months ago and has since retreated by more than 30%.

The bearish picture is further underscored by the fact that the recovery rebound stalled at the classic 61.8% retracement of the autumn decline. At the same time, the pace of decline has increased significantly in recent days. In these conditions, it is worth being prepared for an imminent test of necessary medium-term support in the $80-84K range, where Bitcoin was bought in November and December.

News Background

Bitcoin could fall to the $58K- $62K range, predicts analyst Peter Brandt. According to him, attention has now shifted to this year’s opening levels around $87K as potential support.

Traders on the Deribit derivatives exchange estimate the probability of Bitcoin falling below $80K by the end of June at 30%. At the same time, the likelihood of growth above $120K by the exact date is only 19%.

Strategy has made another large purchase of Bitcoin. Between 12 and 18 January, the company bought 22,305 BTC ($2.12 billion) at an average price of $95,284 per coin. Strategy now owns 709,715 BTC, purchased for $53.9 billion at an average price of $75,979 per bitcoin.

Bitmine, the largest corporate holder of Ethereum, also added 35,268 ETH ($108 million) to its crypto reserves last week. The company’s reserves exceeded 4.2 million ETH.

Canadian billionaire Frank Giustra has questioned Bitcoin’s status as a safe-haven asset. In his opinion, the first cryptocurrency is much easier to confiscate than precious metals, which makes investing in digital assets risky.

The FxPro Analyst Team