Market Picture

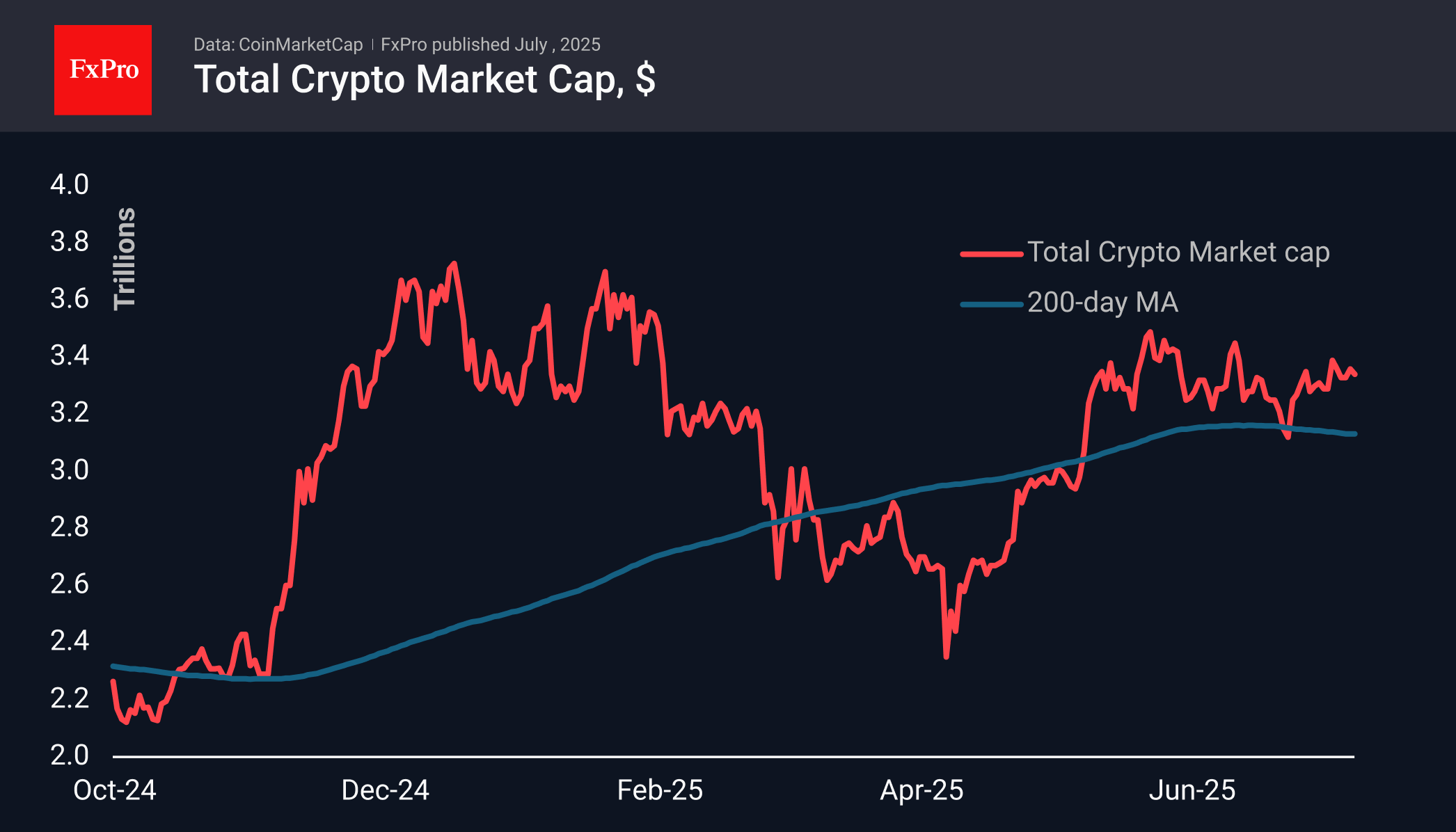

The crypto market capitalisation retains its weekly growth of approximately 1.8%, losing about 0.6% over the last 24 hours to $3.35 trillion. This is another round of buyer indecision at high levels, even though declines were actively bought up. At the same time, capitalisation continues to move away from its 200-day moving average, indicating continued bullish sentiment.

Bitcoin is hovering near $108.5K. Another attempt to develop growth last week resulted in increased sales, pushing the price back to the 50-day moving average. However, this line is an important medium-term support level, attracting buyers. On the other hand, last week’s activity confirmed that sales are picking up as the price approaches $110K, pushing the price down. Buyers are quickly letting off steam, making the market too nervous.

News Background

According to CoinShares, global investment inflows into crypto funds fell 2.5 times last week to $1.042 billion. Investments in Bitcoin increased by $790 million, Ethereum by $226 million, Solana by $22 million, XRP by $11 million, and Sui by $2 million.

Cryptocurrency ETFs saw inflows for the 12th consecutive week, bringing total assets under management to a new all-time high of $188 billion. The moderation of inflows into BTC suggests that investors are becoming more cautious as the asset approaches its historical highs, CoinShares notes.

According to The Block, Bitcoin’s on-chain activity and implied volatility have fallen to their lowest levels in nearly two years, despite the asset approaching historic highs.

Key indicators of activity in the cryptocurrency market point to the onset of a ‘summer lull,’ Glassnode notes. Trading volumes are at their lowest level in a year and continue to fall. A noticeable increase in the value of assets held by Bitcoin holders signals the risk of sell-offs in the event of a change in market sentiment.

The UAE authorities have denied reports that they are issuing ‘golden visas’ to cryptocurrency investors. Previously, the TON Foundation presented a programme for obtaining a 10-year UAE ‘golden visa.’ To participate, investors were offered to invest $100,000 in Toncoin (TON) and pay a fee of $35,000.

The FxPro Analyst Team