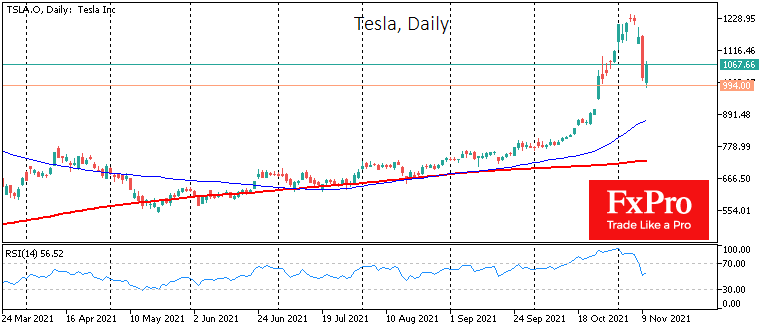

Tesla shares took a severe hit early in the week, retreating 20% from last week’s peak levels to $987 at the start of trading on Wednesday. The price later rebounded to $1067, but it was walking on the edge of a bear market (-20% from the peak). A consolidation below the $994 level would be an informal start to the bear market, paving the way for a deeper correction in one of the most talked-about stocks.

Historically, the onset of a bear market is followed by a further decline in quotations by about another 20%. And the performance of Tesla stock earlier this year observed that pattern: the stock price from the peak of $900 at the end of January found solid support only in the area of $540 (-40%).

The 200-day moving average, from which the stock got sustaining support from May to August, was a solid support level for these difficult times. The October-November acceleration was overheated and needed a correction, but it wasn’t easy to anticipate it would be so rapid and steep.

Given current prices, a day or this week close below $994 would be a technical bear market start, paving the way for a drop to $745. Once again, this could coincide with the level of the 200-day moving average, which now passes through $728 but is pointing upwards.

We also note that along with the rise in price, the rally is getting weaker and weaker, as shown by the series of declining RSI peaks on the weekly charts from 2020 on rising prices. Such divergence suggests the possibility of an even deeper drawdown than the bear market pattern suggests. If Tesla stock does not get support on the downside to 994 today-tomorrow and at 745 at the start of the bear market, we could be talking about a free fall in the $200-250 area, which could well be considered a collapse.

Most worryingly, Tesla stock often acts as a risk demand indicator for the retail investor crowd, foreshadowing tough times for the Nasdaq and S&P500 indices.

The FxPro Analyst Team