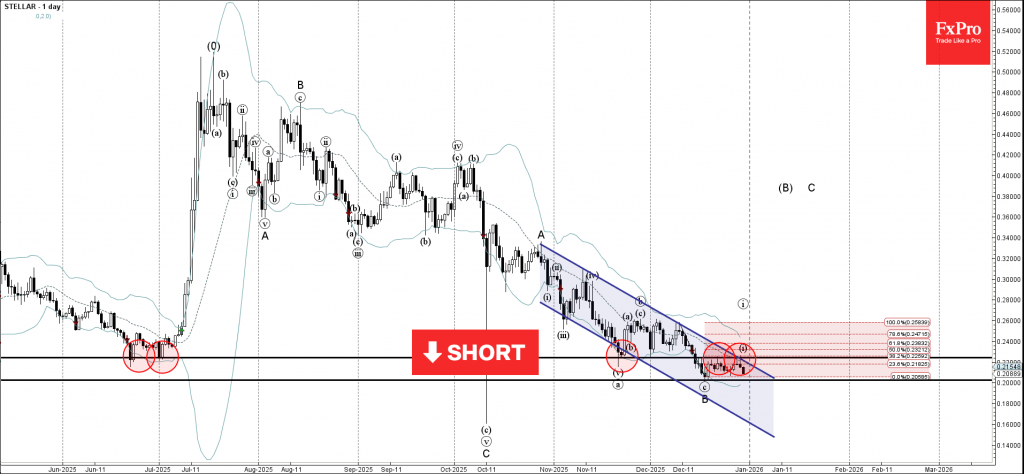

Stellar: ⬇️ Sell

– Stellar reversed from resistance area

– Likely to fall to support level 0.2000

Stellar cryptocurrency recently reversed from the resistance area between the resistance level 0.2240 (former strong support from June, July and November), upper trendline of the daily down channel from October and the 38.2% Fibonacci correction of the downward impulse from the start of December.

The downward reversal from this resistance area created the daily Japanese candlesticks reversal pattern Shooting Star.

Given the clear daily downtrend, Stellar cryptocurrency can be expected to fall to the next strong support level 0.2000 (low of the previous wave B).