The US market worked in full force yesterday, with the debt market returning to action after the long weekend. They retain the trends of recent weeks with pressure on equity and bond markets as investors continue to price in a tightening of the Fed’s monetary policy.

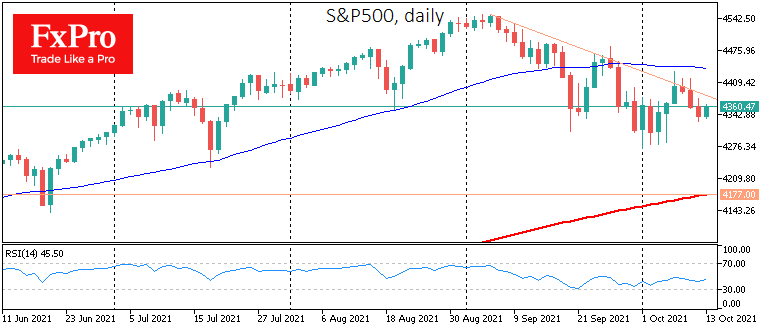

Since the beginning of September, there has been a clear downward trend in the S&P500. Unlike the correction episodes of recent months, we see what appears to be a reluctant slide. But it is this dynamic that has the potential to be the most dangerous trap for speculative bulls. The latter can link to buying on downturns, betting on a rebound after a correction.

More experienced investors and traders are likely to note that equities’ sell-offs have been noticeable in recent weeks as they attempt to rise from increasingly lower levels. The 50-day moving average has been in the role of firm resistance since the end of September, although it was strong support before.

It would not be surprising if the short-term buyers would lose their support in the coming weeks or even days, accelerating the corrective momentum and allowing the S&P500 to pull back from the current 4340 to the 200 SMA, which is now near 4170.

The FxPro Analyst Team