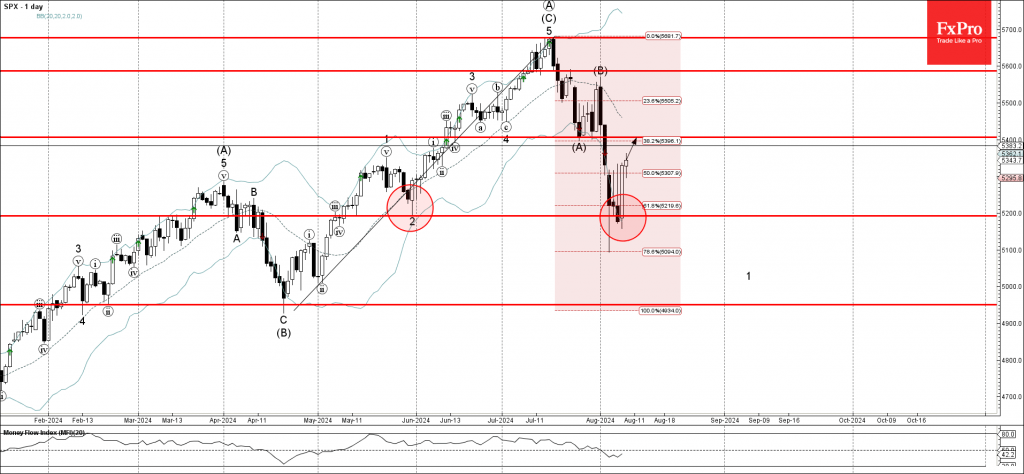

– S&P 500 reversed from resistance zone

– Likely to rise to resistance level 5400.00

S&P 500 index recently reversed up from the support zone located between the key support level 51900.00 (former low of wave 2 from May), lower daily Bollinger Band and the 61.8% Fibonacci correction of the upward impulse from April.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Bullish Engulfing.

Given the predominant daily uptrend, S&P 500 index can be expected to rise further toward the next resistance level 5400.00 (former support from the end of July).