– S&P 500 reversed from support level 5000.00

– Likely to rise to resistance level 5300.00

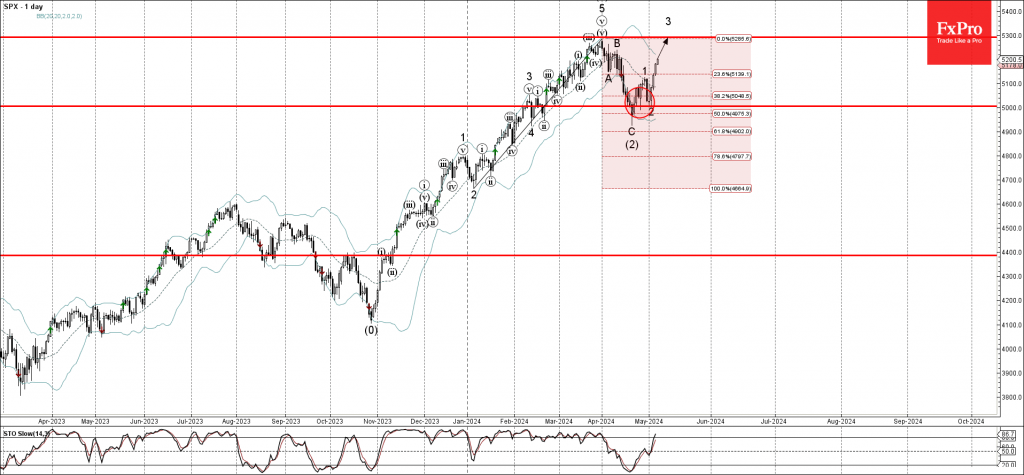

S&P 500 index recently reversed up from the support zone lying between the round support level 5000.00 (which also stopped the previous correction (2)), lower daily Bollinger Band and the 50% Fibonacci correction of the upward impulse from January.

The upward reversal from the support level 5000.00 stopped the previous short-term correction 2.

Given the strong uptrend that can be seen on the daily charts, S&P 500 index can be expected to rise further to the next resistance level 5300.00 (which stopped the previous impulse wave 5 at the end of March).