– S&P 500 broke round resistance level 6000.00

– Likely to rise to resistance level 6130.00

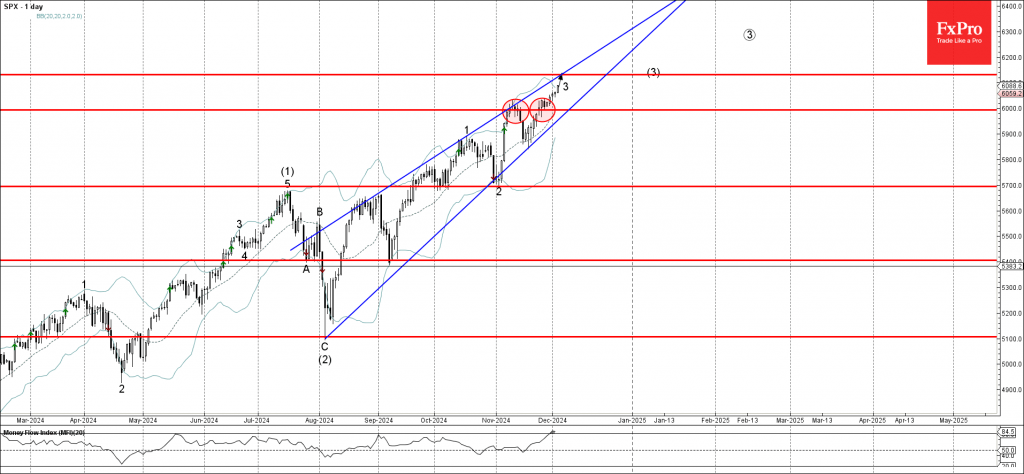

S&P 500 index continues to rise steadily after breaking the round resistance level 6000.00, which stopped the earlier upward impulse wave at the start of November.

The breakout of the resistance level 6000.00 accelerated the active minor impulse wave 3 of the intermediate impulse wave (3) from August.

Given the strong daily uptrend, S&P 500 index can be expected to rise in the active extended daily Wedge toward the next resistance level 6130.00, target price for the completion of the active impulse wave 3.