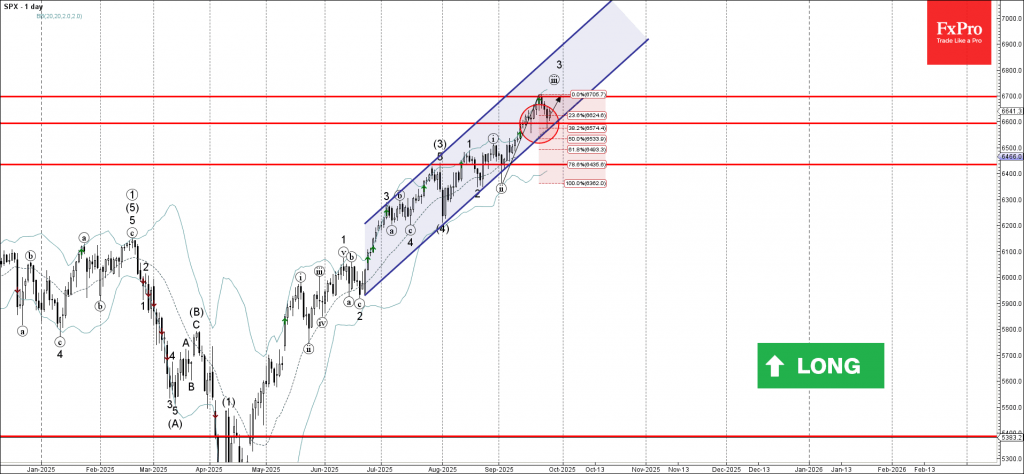

S&P 500: ⬆️ Buy

– &P 500 index reversed from support level 6600.00

– Likely to rise to resistance level 6700.00

S&P 500 index recently reversed up from the key support level 6600.00 (which also reversed the index in the middle of September) coinciding with the 20-day moving average and the 38.2% Fibonacci correction of the upward impulse from last month.

The upward reversal from the support level 6600.00 continues the active short-term impulse wave 3 of the intermediate impulse wave (5) from the start of August.

Given the strong daily uptrend, S&P 500 index can be expected to rise further to the next resistance level 6700.00 (which reversed the price earlier this month).