– S&P 500 continues daily uptrend

– Likely to rise to resistance level 5675.00

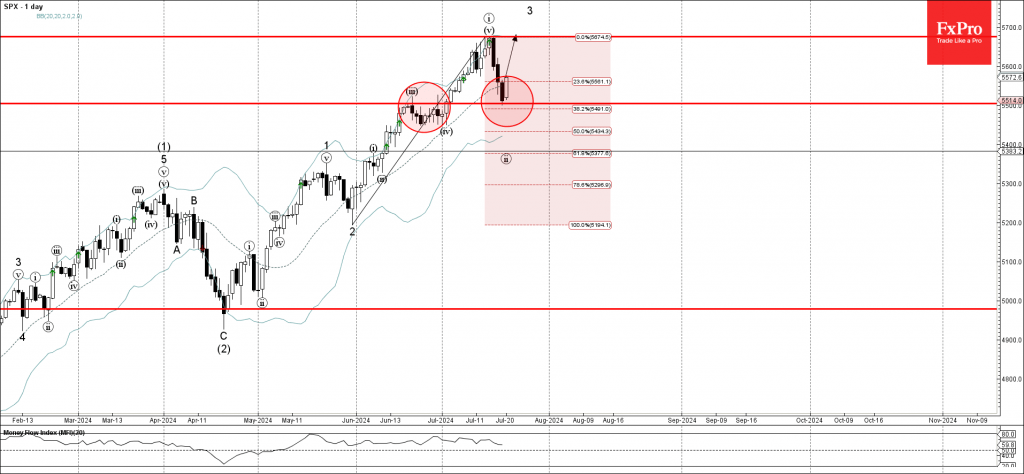

S&P 500 Index recently reversed from the support area between the key support level 5500.00 (former resistance from June) and the 38.2% Fibonacci correction of the previous upward impulse from May.

The upward reversal from this support area will likely form the daily Japanese candlesticks reversal pattern Bullish Engulfing if the price closes today near the current levels – a strong buy signal for this index.

Given the clear daily uptrend, S&P 500 Index can be expected to rise further to the next resistance level 5675.00 (top of the previous wave i).