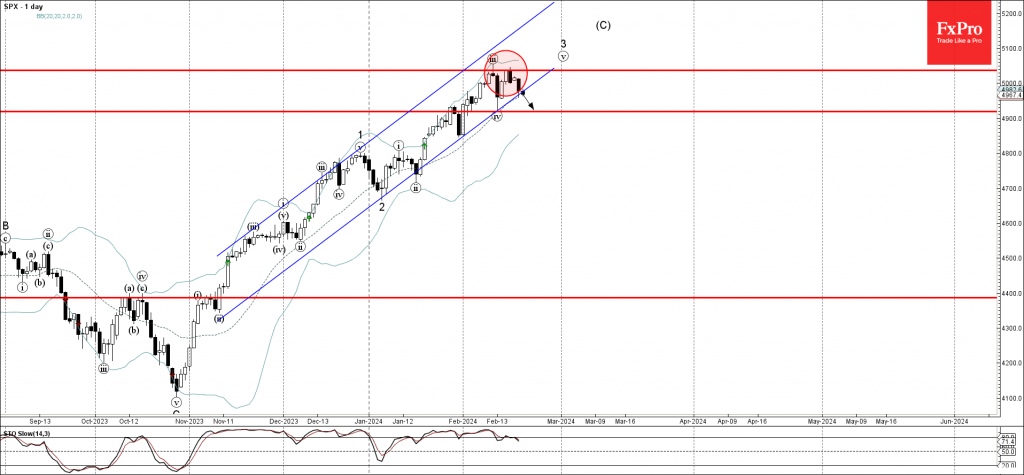

– S&P 500 reversed from resistance level 5035.00

– Likely to fall to support level 4920.00

S&P 500 index recently reversed down from the pivotal resistance level 5035.00 (which stopped the previous minor impulse wave iii at the start of this month).

The downward reversal from the resistance level 5035.00 created the daily Japanese candlesticks reversal pattern Bearish Engulfing, which was preceded by the daily Evening Star near this price level.

Having just broken the sharp daily up channel from November, S&P 500 index can be expected to fall further to the next support level 4920.00 (low of the previous wave iv).