• S&P 500 reversed from support level 4080.00

• Likely to rise to resistance level 4200.00

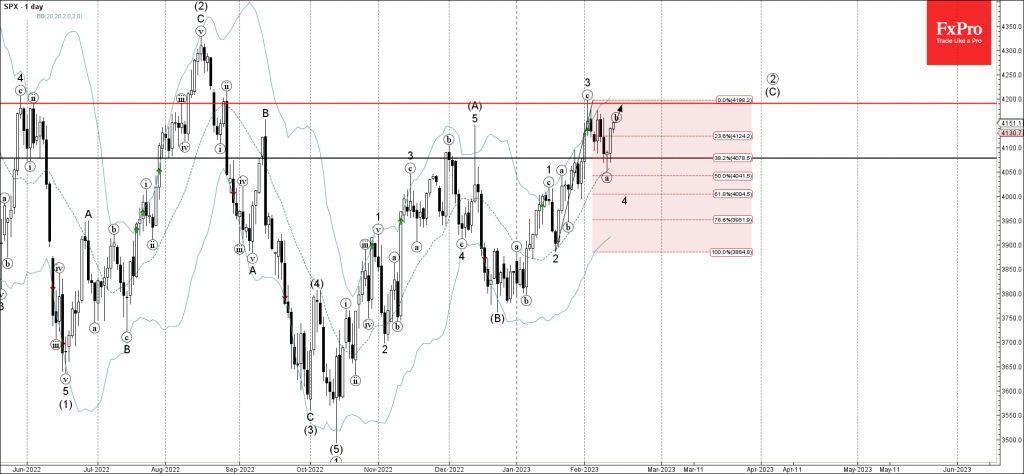

S&P 500 index recently reversed up from the support level 4080.00 (former resistance from the end of January), standing near the 20-day moving average and the 38.2% Fibonacci correction of the upward impulse from January.

The upward reversal from the support level 4080.00 created the daily Japanese candlesticks reversal pattern Morning Star – which ended earlier wave a.

S&P 500 index can be expected to rise further toward the next resistance level 4200.00 (which stopped the previous impulse wave 3).