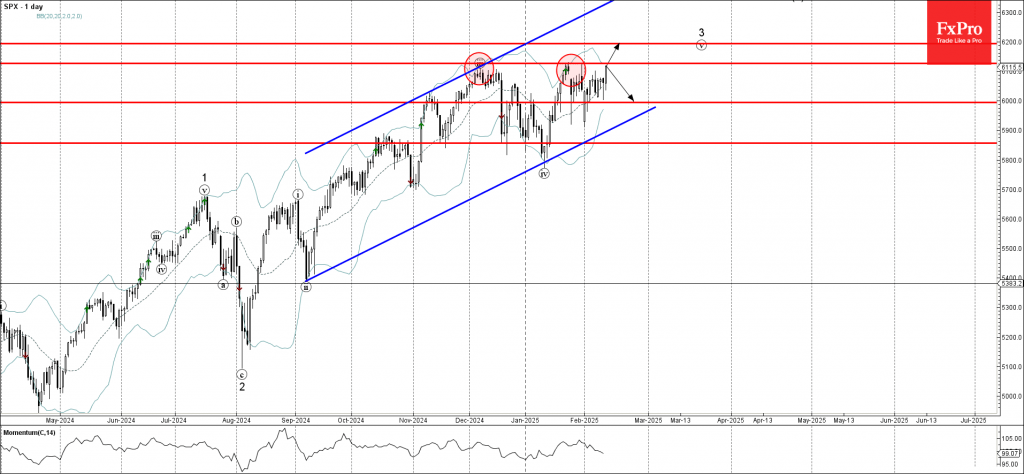

– S&P 500 approaching key resistance level 6125.00

– Likely to rise to resistance level 6200.00

S&P 500 index recently rose sharply and is currently approaching the key resistance level 6125.00, which has been reversing the index from December.

The subsequent price movement will depend on whether the index can break above the resistance level 6125.00 .

If the S&P 500 index breaks above 6125.00, the price can then rise to the next resistance level 6200.00 (target price for the completion of the active impulse wave 3). In the opposite scenario, the price is likely to correct down to the next round support level 6000.00.