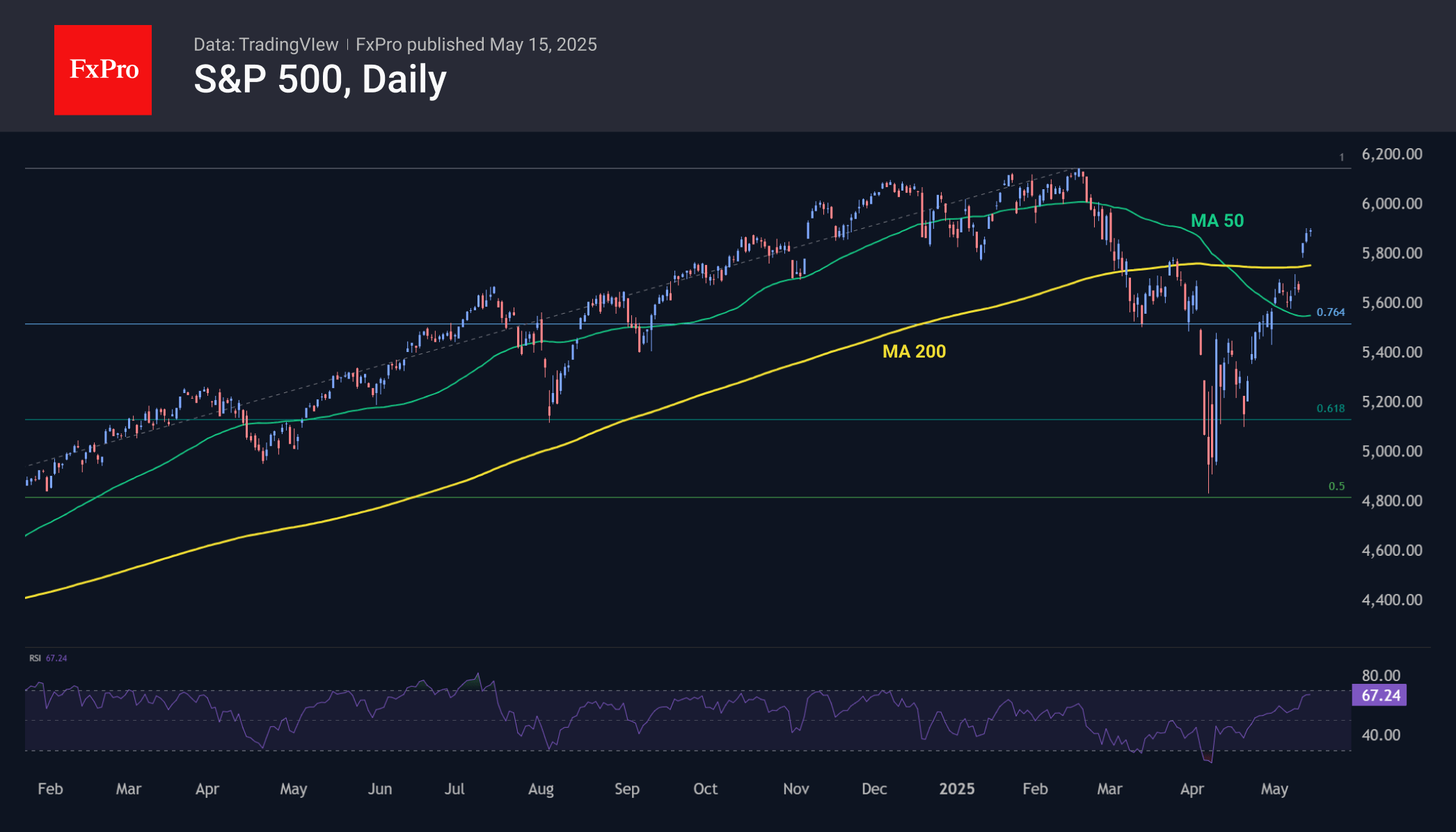

The S&P 500 Index has surpassed levels from the beginning of the year, up about 23% from the lows reached in early April. The market is currently just 4% below the area of highs that functioned as active resistance from December to February. This raises the question of whether resistance at the 6,000 point level on the S&P 500 is still relevant.

The market decline from February, which turned into a significant drop in April, may have contributed to the market’s recovery and set the stage for a rally. On weekly timeframes over the past 14 years, the market’s approach to the 200-week moving average has served as an indicator of profitable buying. This year was no exception, although the S&P 500 fell slightly short of that line, like the situation in October 2023. Most bounces from this level in recent years have coincided with changes in monetary policy.

However, tariff policy, not monetary policy, was the main market driver this year. Negotiations aimed at lowering rates caused an increase in market activity, replacing Fed action. In recent days, there have been signs of progress in tariff negotiations, supporting market growth.

Technical indicators also support a positive trend. With the last major correction, the S&P 500 gave back half of the gains from the lows of October 2022. This decline is consistent with technical market correction patterns, which are often followed by an update of historical highs. The lows of the current correction are almost identical to the peaks prior to the 2022 decline.

Historical data shows different market development scenarios near the previous highs, and we should expect possible volatility in the 6000-6100 range. The market’s upside potential is also evident from past data: the February highs corresponded to 150% of the 2020-2022 rally, indicating a possible target around 7500.

The FxPro Analyst Team