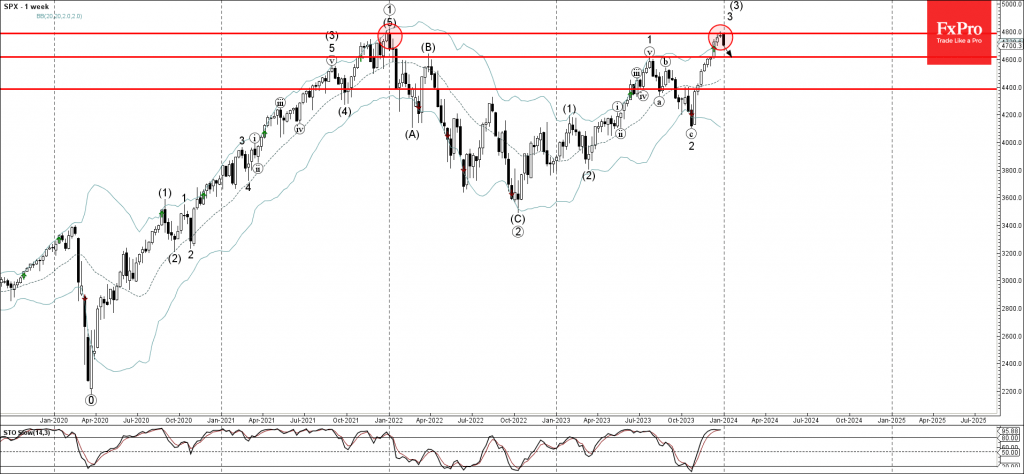

– S&P 500 index reversed from resistance level 4800

– Likely to fall to support level 4600.00

S&P 500 index recently reversed down from the major long-term resistance level 4800.00 (which stopped the sharp weekly uptrend at the end of 2021).

The resistance level 4800.00 was strengthened by the upper daily and weekly Bollinger Bands.

Given the strength of the resistance level 4800.00 and the strongly overbought weekly Stochastic, S&P 500 index can be expected to fall further to the next support level 4600.00.