– S&P 500 reversed from support level 4330.0

– Likely to rise to resistance level 4450.00

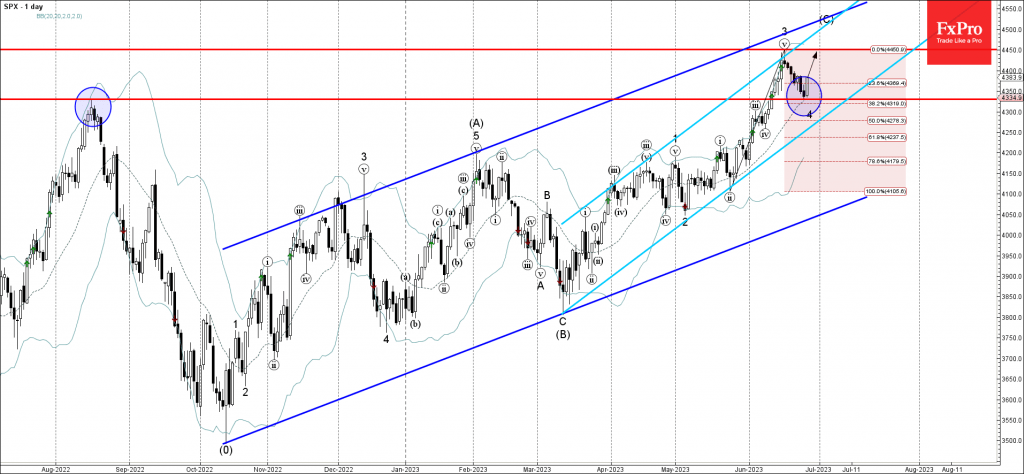

S&P 500 index recently reversed up from the key support level 4330.0 (former multi-month high from August of 2022, acting as the support after it was broken at the start of June) standing near the 38.2% Fibonacci correction of the upward impose from May.

The upward reversal from the support level 4330.00 stopped the previous short-term corrective wave 4.

Given the prevailing uptrend, S&P 500 index can be expected to rise further toward the next resistance level 4450.00 (top of the previous impulse wave 3).