– S&P 500 Index under bearish pressure

– Likely to fall to support level 5200.00

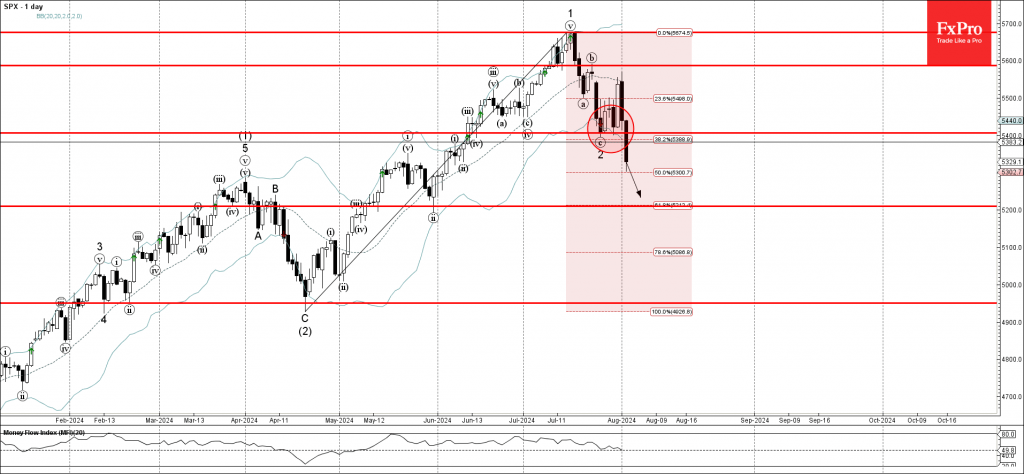

S&P 500 Index is under the bearish pressure after the price broke below the key support level 5400.00, which reversed the price with two consecutive Bullish Engulfing reversal patterns at the end of July.

The breakout of the support level 5400.00 coincided with the breakout of the 38.2% Fibonacci correction of the upward impulse 1 from April.

Given the prevailing pessimism that can be seen across the equity markets today, S&P 500 Index can be expected to fall further toward the next support level 5200.00 (low of wave ii from the end of May).