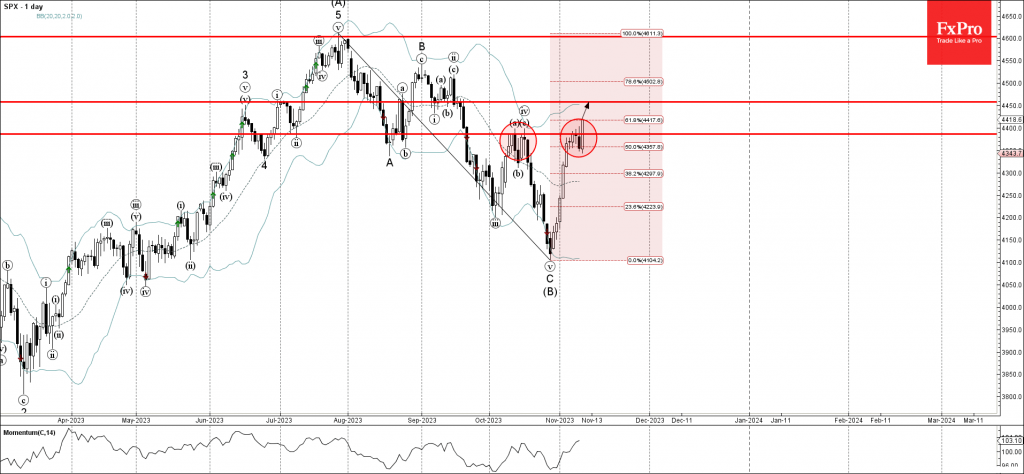

– S&P 500 broke key resistance level 4385.00

– Likely to rise to resistance level 4450.00.

S&P 500 index recently broke the key resistance level 4385.00 (previous double top from October) standing near the 50% Fibonacci correction of the downward ABC correction 2 from July.

The breakout of the resistance level 4385.00 accelerated the active medium-term impulse wave (3).

Given the prevalence of the risk-on sentiment seen today, S&P 500 index can be expected to rise further toward the next resistance level 4450.00.