S&P 500 index: ⬆️ Buy

– S&P 500 broke resistance level 6800.00

– Likely to rise to resistance level 7000.00

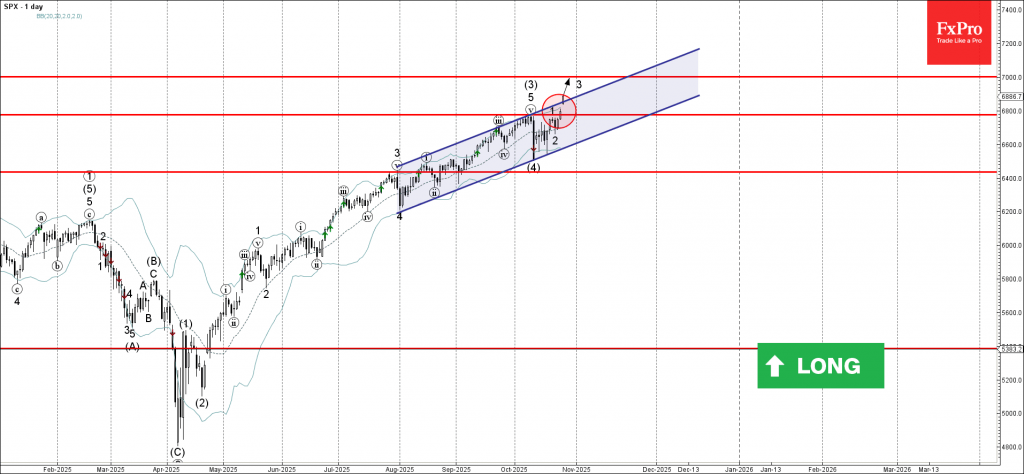

S&P 500 index opened today with the upward gap which broke the key resistance level 6800.00 (which stopped the previous impulse wave (3) at the start of October, as can be seen from the daily S&P 500 index chart below).

The breakout of the resistance level 6800.00 accelerated the active minor impulse wave 3 of the medium-term impulse sequence (5) from the start of this month.

Having just broken out of the daily up channel from August, S&P 500 index can be expected to rise to the next round resistance level 7000.00, target price for the completion of the active impulse wave 3.