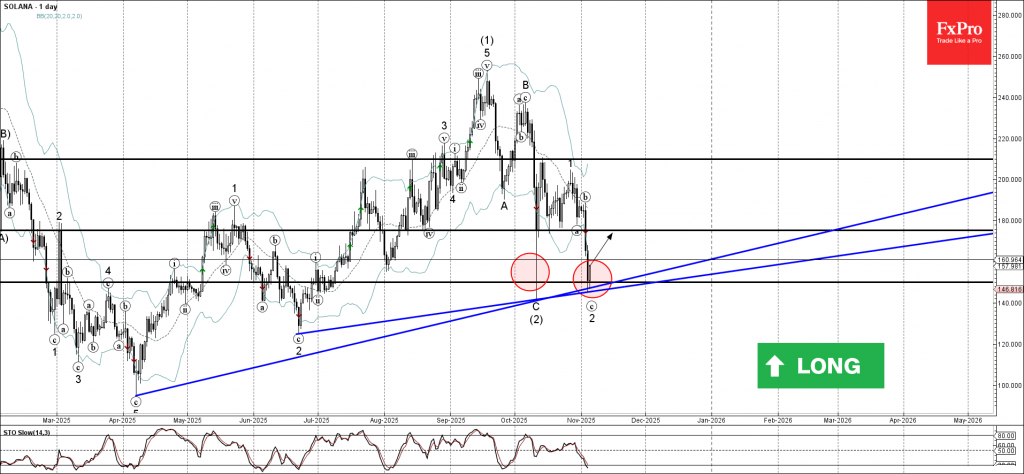

Solana: ⬆️ Buy

– Solana reversed from key support level 150.00

– Likely to rise to resistance level 175.20

Solana cryptocurrency recently reversed from the support area between the key support level 150.00 (which stopped the previous sharp downward correction (2) at the start of October), lower daily Bollinger Band and the two support trendlines from June and April.

The upward reversal from the support area stopped the impulse C-wave of the earlier ABC correction (2) from September.

Given the strength of the support level 150.00 and the oversold daily Stochastic indicator, Solana cryptocurrency can be expected to rise to the next resistance level 175.20 (former support from October).