– Silver under bullish pressure

– Likely to rise to resistance level 36.00

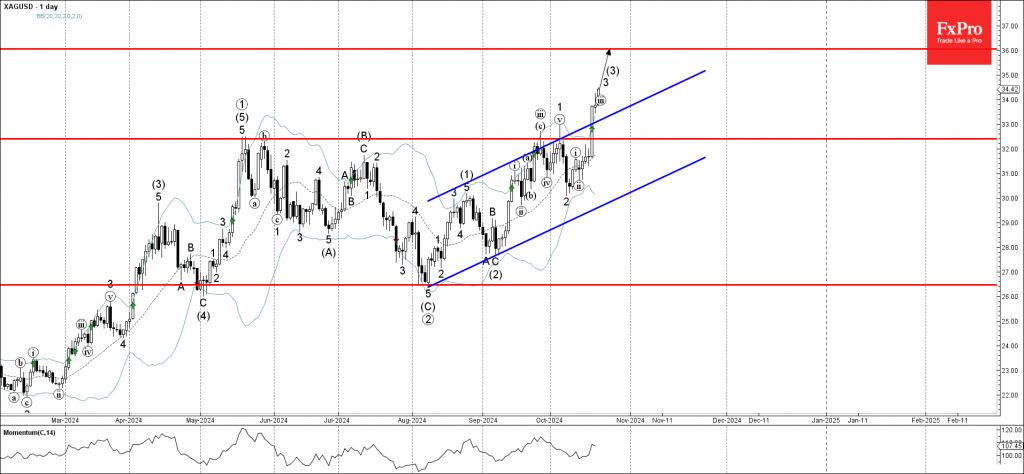

Silver is under bullish pressure after the earlier breakout of the resistance level 32.40 (which has been steadily reversing the price from the middle of May) intersecting with the resistance trendline of the daily up channel from the start of August.

The breakout of the resistance level 32.40 accelerated the active short-term impulse wave 3 of the higher impulse wave (3) from the start of September.

Given the clear daily uptrend, Silver can be expected to rise toward the next resistance level 36.00, the target price for the completion of the active impulse wave (3).