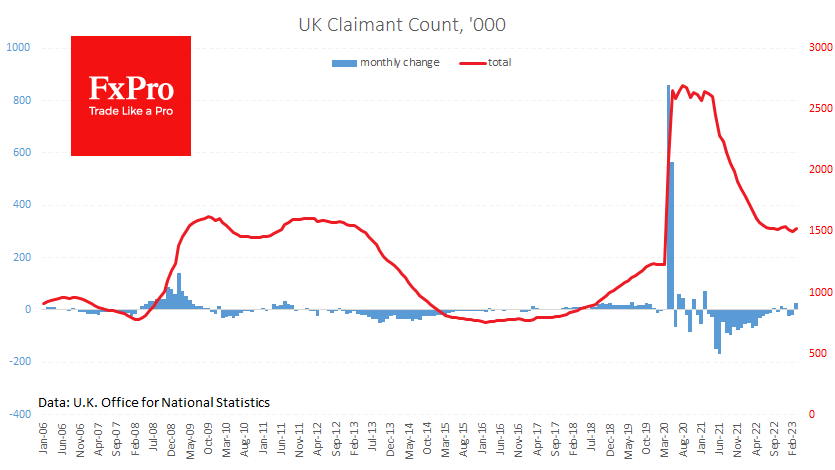

The labour market situation in the UK is worrying. Claimant counts rose by 28.2K in March, following two months of falls by 21.5K and 18.8K, and forecasts for a fall of 2.5K last month. In a broader picture, the number of people out of work has been broadly stable over the past nine months, hovering around 1,525K. This level was a ceiling for a long time between 2009 and 2013, as the country recovered from the financial crisis. By this measure, the labour market has considerable room for improvement.

At the same time, the unemployment rate rose to 3.8% in the December-February period, from 3.7% previously and a low of 3.5% in the three months to August, as more people joined the job search amid rising inflation and recovery from the pandemic.

Meanwhile, the rate of wage growth excluding bonuses shows no significant signs of cooling at 6.6% y/y, while earnings, including bonuses, have stabilised around 6% for the past seven months. This trend generally indicates a decline in the bonus component and could signal a consolidation of inflationary trends.

Such news has a net positive effect on the Pound, allowing us to expect further interest rate hikes in the coming months. At the same time, monitoring the labour market to see if a rise in claimants is becoming a trend is essential. Sterling traders should also pay attention to tomorrow’s UK inflation data, which could either support or reverse expectations of further rate hikes.

The FxPro Analyst Team