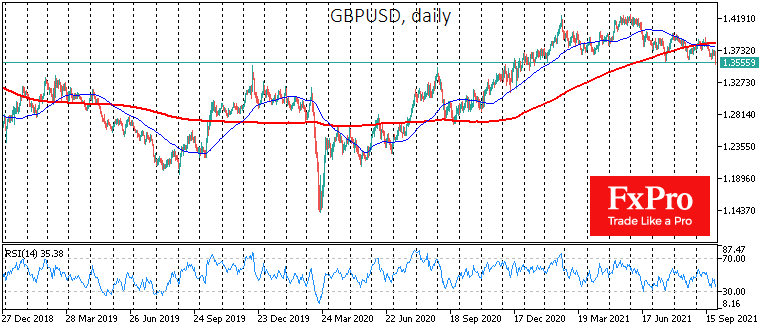

The British Pound is losing 1.15% on Tuesday, slipping to an eight-month low at 1.3540, as supply chain chaos had a more substantial impact on the currency now than the hawkish comments from the Bank of England last week.

Particularly worrying is that the Pound’s downward movement could be backed up by technical factors, which would increase sellers’ pressure. GBPUSD has fallen below a significant support level near 1.3700, where buying has intensified this year. A wave of stop orders on the way out of the established ranges creates a potential for a deeper correction to 1.3440 and further to 1.3000.

The EUR/GBP pair has also come alive today, adding 1.05% since the start of the day. This is the pair’s third-biggest one-day gain this year. The Euro to Pound is predominantly trading in a wide range, and the latest move cements a reversal from the lows in the 0.8500 area, potentially opening a fast track to 0.9100.

The FxPro Analyst Team