Boris Johnson has tightened up the deadlines again, pushed Pound Sterling lower. The official Brexit date remains 31 January 2020. Further, there should be a transition period of 2-3 years aimed to conclude a comprehensive trade deal with the EU. But the British Prime Minister proposes to cut this period to just 11 months, by 31 December 2020. If not, the trade falls under WTO rules, which are more burdensome for business.

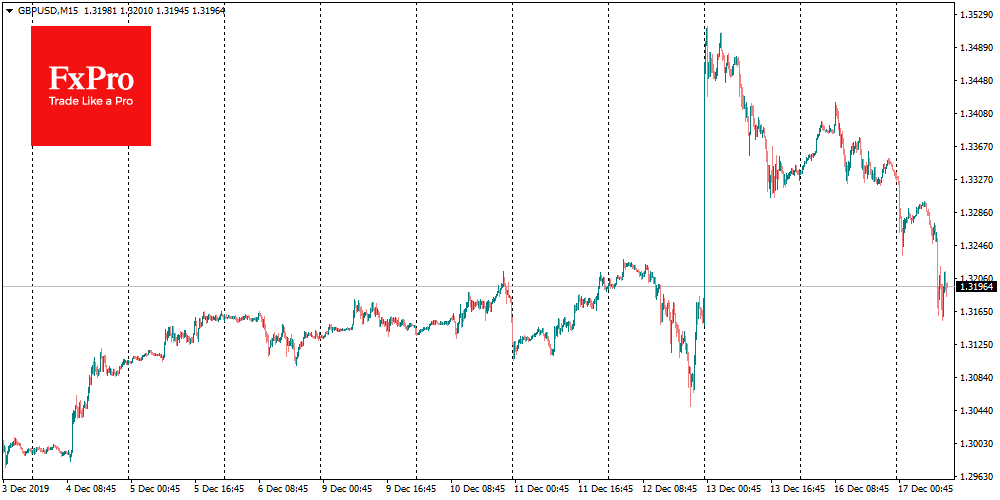

This story with the prospect of shortening the terms does not please the markets. The pound lost 1.2% after the first comments, declining below $1.32 and fully offset the after the election rally. New fears of a “hard Brexit” put pressure on the pound and may return market worries about lose-lose changes in UK-EU relationships.

The FxPro Analyst Team