– NZDUSD reversed from key resistance level 0.6020

– Likely to fall to support level 0.5900

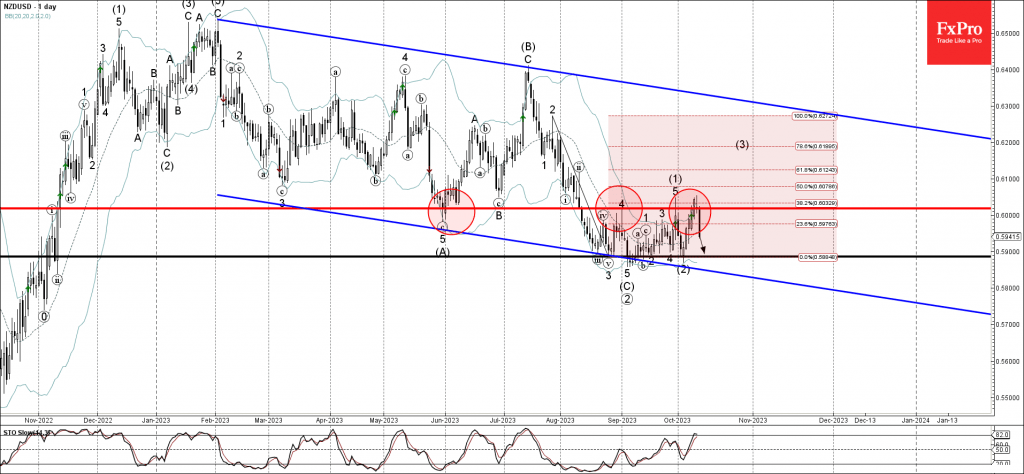

NZDUSD currency pair recently reversed down from the key resistance level 0.6020 (former strong support from June, which stopped the previous waves 4 and 1), intersecting with the upper daily Bollinger Band.

The downward reversal from the resistance level 0.6020 is currently forming the daily candlesticks reversal pattern Evening Star Doji.

Given the clear daily downtrend, overbought daily Stochastic and the continued NZD sales, NZDUSD can be expected to fall further toward the next support level 0.5900, which reversed multiple waves from August.