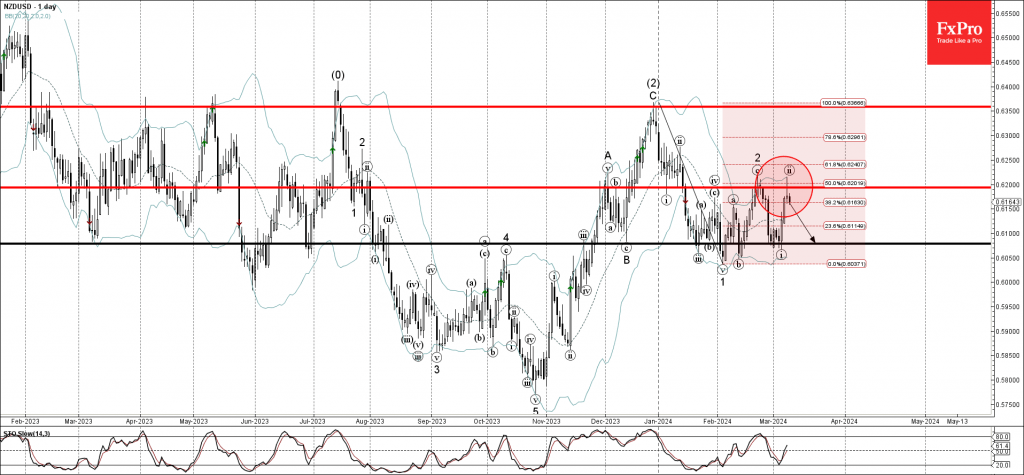

– NZDUSD reversed from resistance level 0.6200

– Likely to fall to support level 0.6080

NZDUSD currency pair today reversed down from the resistance level 0.6200 (which stopped the previous minor ABC correction 2 in the middle of February) intersecting with the 50% Fibonacci correction of the downward impulse 1 from January.

The downward reversal from the resistance level 0.6200 created the daily candlesticks reversal pattern Shooting Star.

Given the strength of the resistance level 0.62000, NZDUSD currency pair can be expected to fall further toward the next support level 0.6080 (low of the previous wave i).