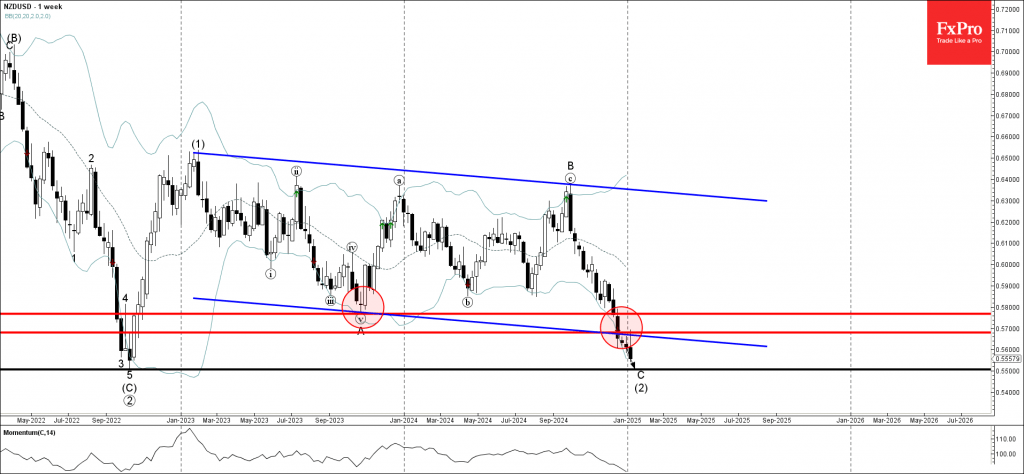

– NZDUSD falling inside weekly impulse wave C

– Likely to fall to support level 0.5500

NZDUSD currency pair recently reversed down from the lower trendline of the wide weekly down channel from the start of 2023 (which is acting as the resistance after it was broken in December).

The downward reversal from this down channel accelerated the active impulse C-wave of the weekly downward ABC correction (2) from the start of last year.

Given the strong downtrend on the weekly charts, NZDUSD currency pair can be expected to fall toward the next long-term support level 0.5500 (which stopped the sharp weekly downtrend at the end of 2022).