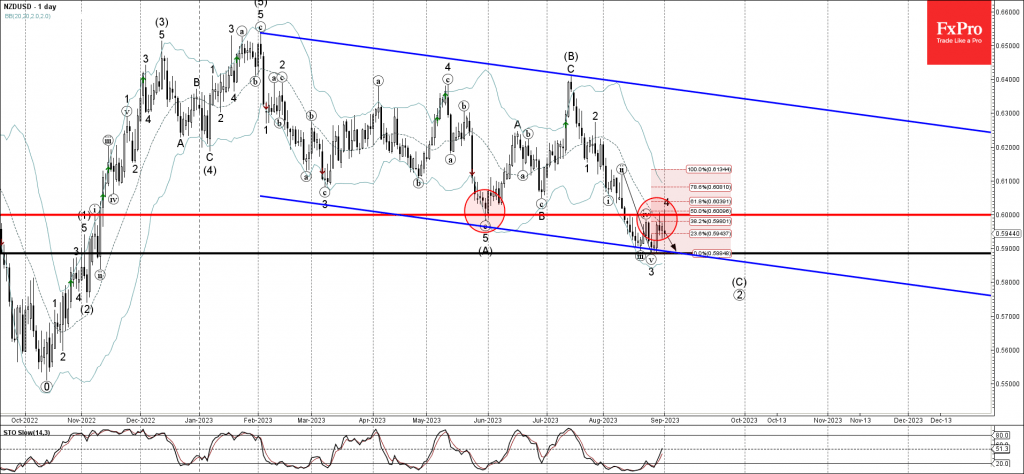

– NZDUSD reversed from resistance level 0.6000

– Likely to fall to support level 0.5900

NZDUSD currency pair recently reversed down from the strong round resistance level 0.6000 (former multi-month support from June), coinciding with the 20-day moving average and the 50% Fibonacci correction of the downward impulse from the start of August.

The downward reversal from the resistance level 0.6000 stopped the wave 4 of the active sharp downward impulse wave C from July.

Given the overriding daily downtrend, NZDUSD can be expected to fall further toward the next support level 0.5900 (low of the previous impulse wave 3).