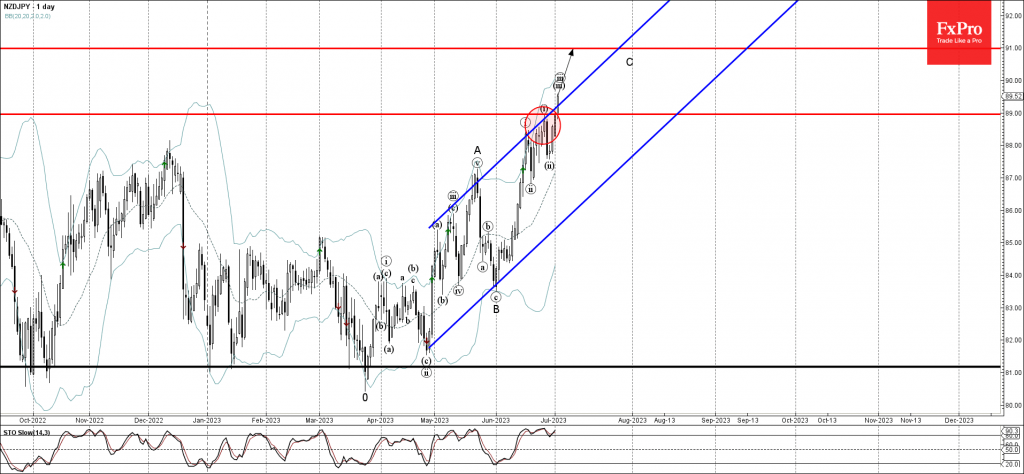

– NZDJPY broke resistance zone

– Likely to rise to resistance level 91.00

NZDJPY currency pair rising steadily after the earlier breakout of the resistance zone located between the resistance level 89.00 and the resistance trendline of the daily up channel from April.

The breakout of this resistance zone accelerated the active short-term impulse wave (iii) of the C-wave from June.

Given the strength of the active C-wave and the strong yen sales, NZDJPY can be expected to rise further toward the next resistance level 91.00 (target price for the active C-wave).