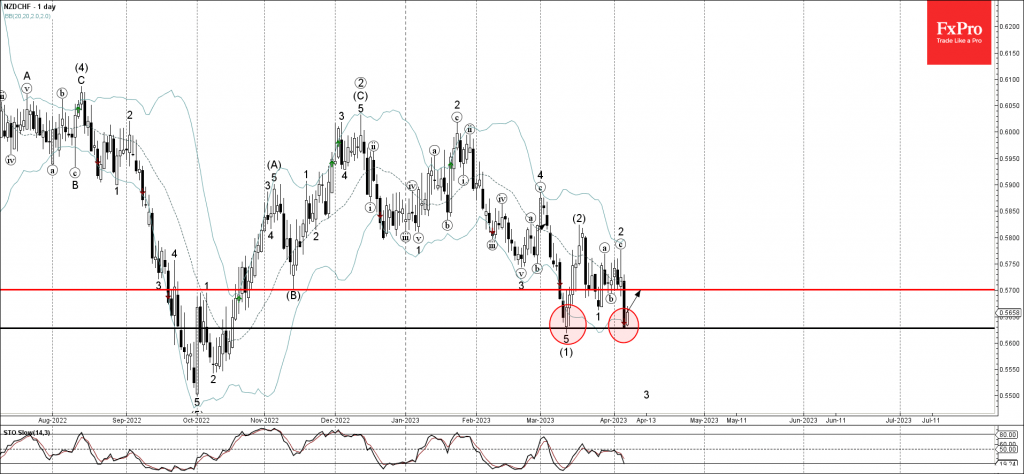

• NZDCHF reversed from key support level 0.5630

• Likely to rise to resistance level 0.5700

NZDCHF recently reversed up from the key support level 0.5630 (previous monthly low from the middle of March) intersecting with the lower daily Bollinger Band.

The upward reversal from the support level 0.5630 stopped the previous short-term impulse wave 3 – which belongs to the intermediate impulse wave (3) from March.

Given the oversold daily Stochastic, NZDCHF can then be expected to rise further toward the next resistance level 0.5700.