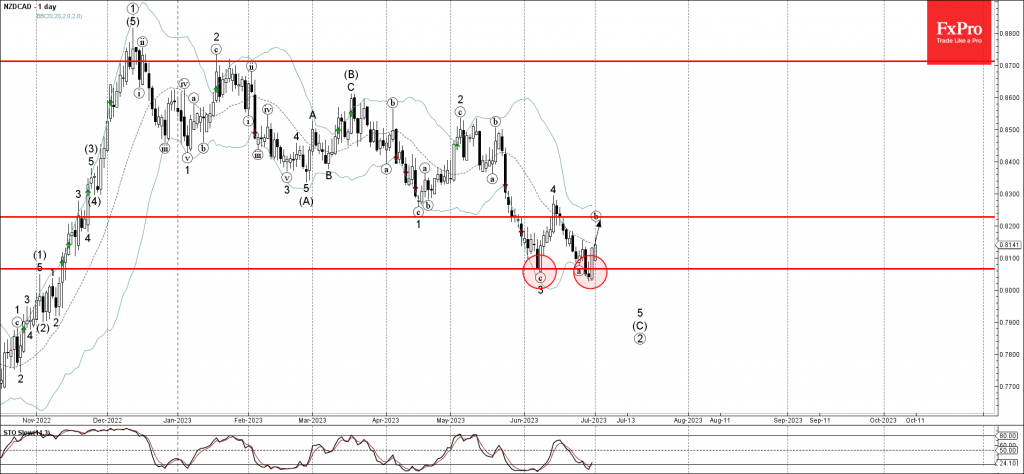

– NZDCAD reversed from strong support level 0.8065

– Likely to rise to resistance level 0.8230

NZDCAD currency pair recently reversed up with the daily Morning Star from the strong support level 0.8065 (low of the previous impulse wave 3) intersecting with the lower daily Bollinger Band.

The upward reversal from the support level 0.8065 started the (b)-wave of the active ABC correction (B) from the end of June.

Given the strength of the support level 0.8065, NZDCAD can be expected to rise further toward the next resistance level 0.8230 (target price for the completion of the active wave (b)).