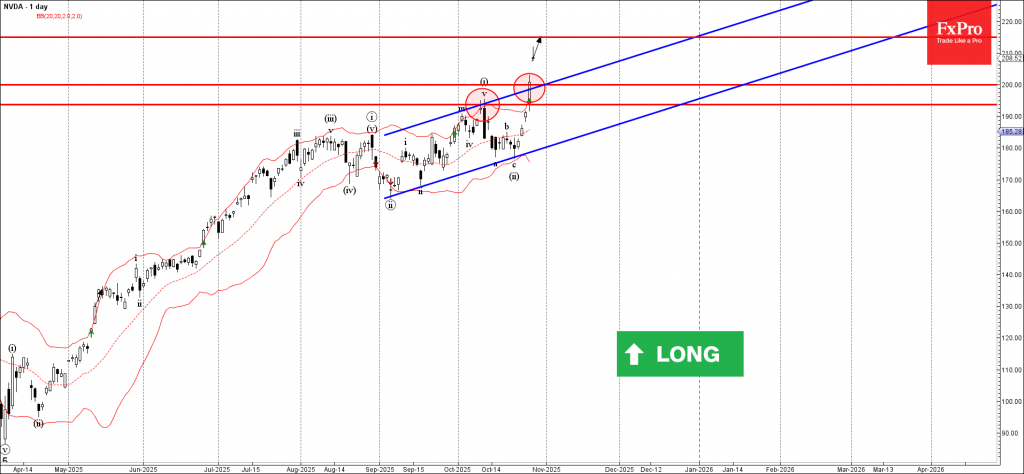

NVDA: ⬆️ Buy

– NVDA opened with the upward gap

– Likely to rise to resistance level 215.00

NVDA stock opened today with the sharp upward gap, which follows the earlier breakout of the resistance zone between the resistance levels 193.75 and 200.00.

The breakout of the these resistance levels accelerated the active impulse wave iii of the extended intermediate impulse sequence 5 from April

Given the overriding daily uptrend, NVDA can be expected to rise to the next resistance level 215.00 (target price for the completion of the active impulse wave iii).