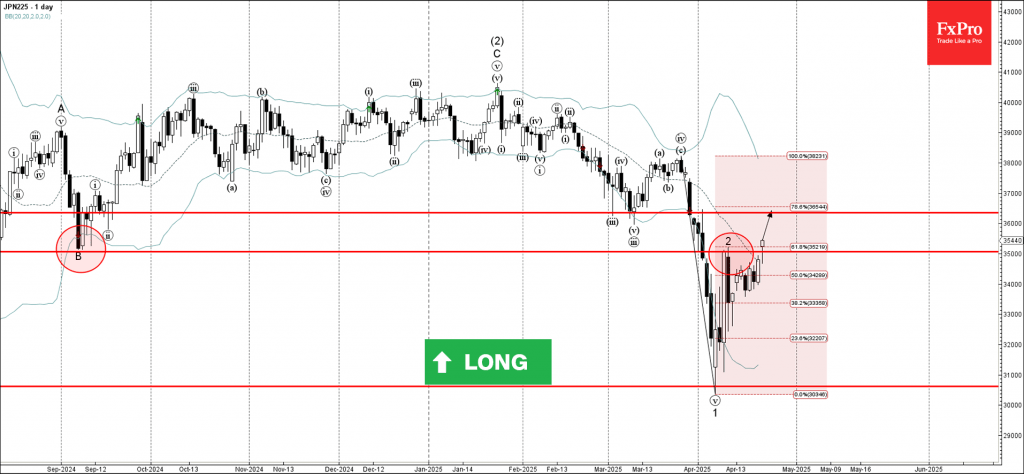

Nikkei 225: ⬆️ Buy

– Nikkei 225 broke the resistance area

– Likely to rise to resistance level 36355.00

Nikkei 225 index recently broke the resistance area between the pivotal resistance level 35000.00 (which stopped the previous correction 2, former strong support from September) and the 61.8% Fibonacci correction of the downward impulse from March.

The breakout of this resistance area would extend the earlier short-term ABC correction 2 from the start of April.

Nikkei 225 index can be expected to rise toward the next resistance level 36355.00 (former support which stopped the previous corrections iii and v last month).