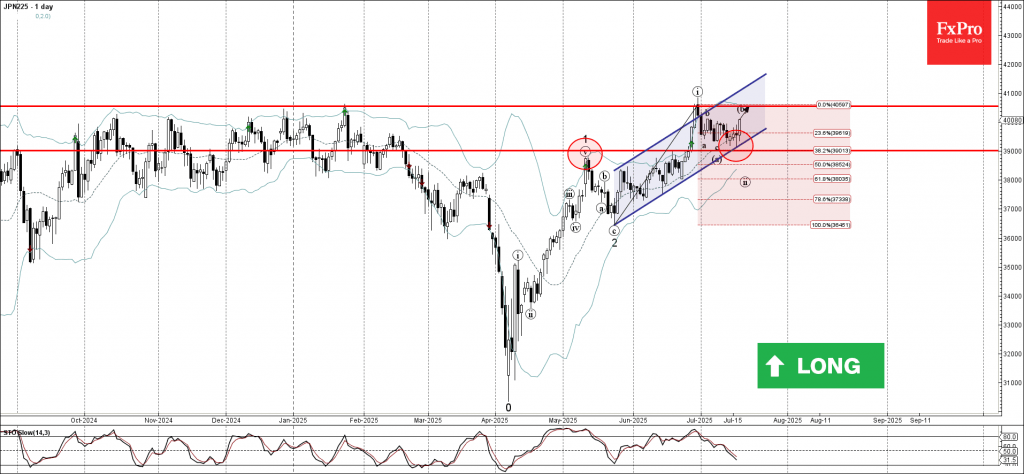

Nikkei 225: ⬆️ Buy

– Nikkei 225 reversed from support area

– Likely to rise to resistance level 40550.00

Nikkei 225 index recently reversed up with the daily Doji from the support area located between the key support level 39000.00 (former resistance from May) and the support trendline of the daily up channel from May.

This support area was further strengthened by the 38.2% Fibonacci correction of the sharp upward impulse i from May.

Given the strong daily uptrend and the improved sentiment across global equity markets, Nikkei 225 index can be expected to rise to the next resistance level 40550.00 (former multi-month high from January).