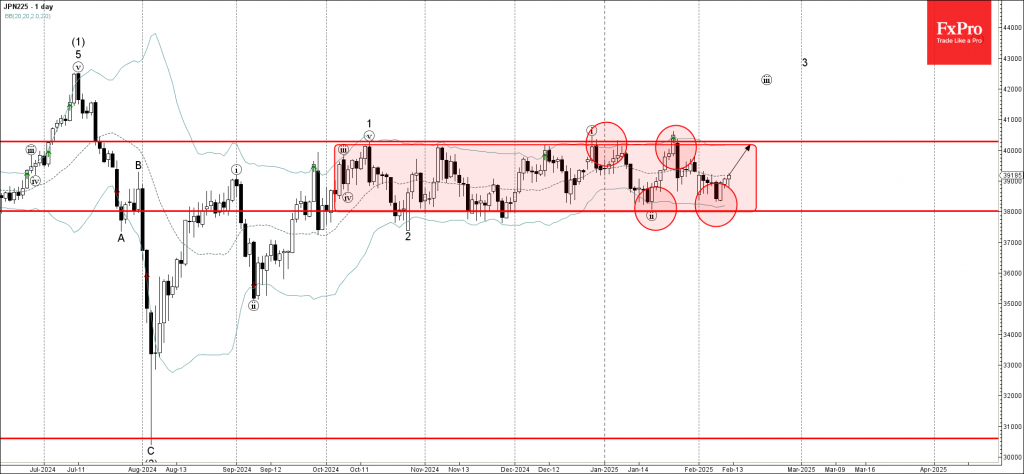

– Nikkei 225 index reversed support level 38000.00

– Likely to rise to resistance level 40285.00

Nikkei 225 index recently reversed up from the support level 38000.00, which is the lower border of the narrow sideways price range inside which the index has been moving from last October. This support area was strengthened by the lower daily Bollinger Band

The upward reversal from this support area created the daily Japanese candlesticks reversal pattern Piercing Line.

Given the clear daily uptrend, Nikkei 225 index can be expected to rise to the next resistance level 40285.00 (the upper border of this price range).