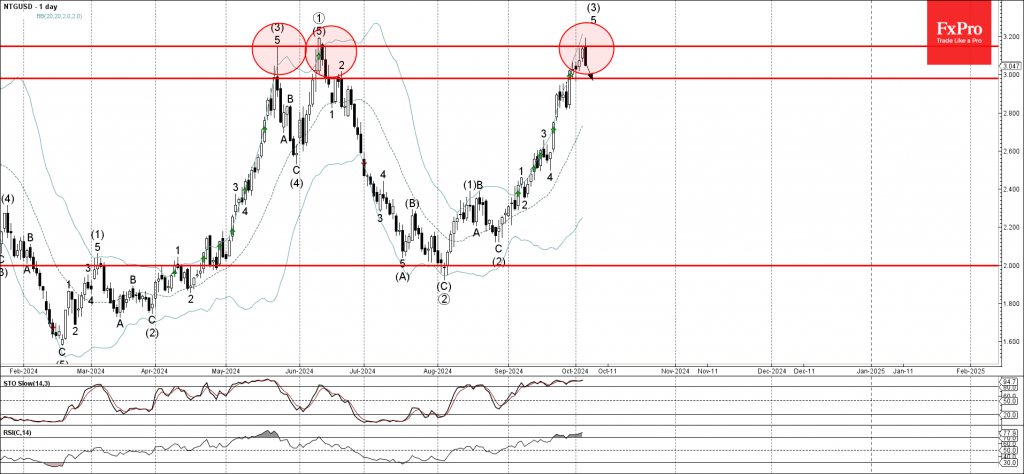

– Natural gas reversed from long-term resistance level 3.150

– Likely to fall to support level 3.0000

Natural gas recently reversed down from the long-term resistance level 3.150 (the previous month’s high from May and June).

The resistance level 3.150 was strengthened by the upper daily Bollinger Band. If natural gas closes today near the current levels it will then form the daily Bearish Engulfing.

Given the strength of the resistance level 3.150 and the overbought daily Stochastic and RSI, Natural gas can be expected to fall further to the next round support level 3.0000.