- Natural gas under the bearish pressure

- Likely to fall to support level 2.200

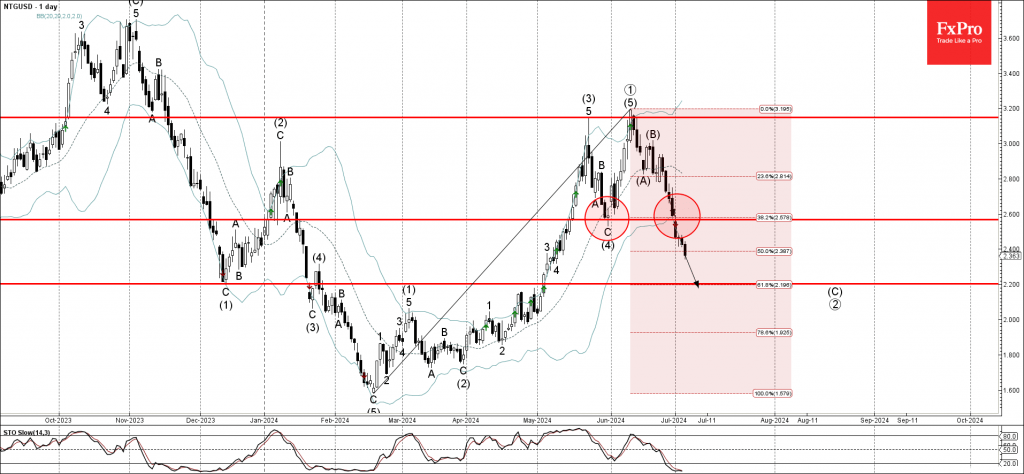

Natural gas is under bearish pressure after the earlier breakout of the key support level 2.600 (which stopped the previous medium-term ABC correction (4) from the end of May).

The breakout of the support level 2.600 coincided with the breakout of the 38.2% Fibonacci correction of the previous sharp upward impulse from February.

Natural gas can be expected to fall further toward the next support level 2.200, the target price for the completion of the active impulse wave (C).