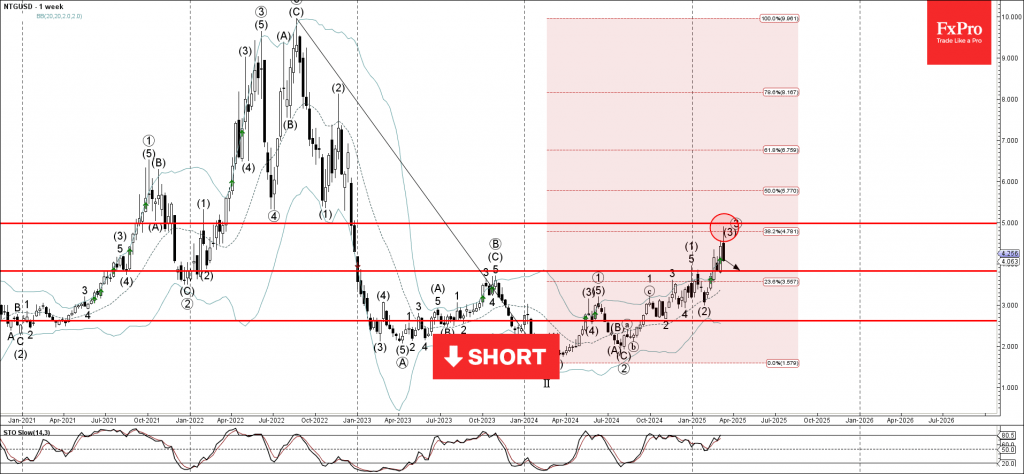

Natural gas: ⬇️ Sell

– Natural gas reversed from round resistance level 5.0000

– Likely to fall to support level 3.815

Natural gas recently reversed from the resistance area between the round resistance level 5.0000, the upper weekly Bollinger Band and the 38.2% Fibonacci correction of the downward impulse from 2022.

The downward reversal from this resistance area stopped the earlier weekly upward impulse sequence (3) from the start of 2025.

Given the recent formation of the daily Shooting Star and the overbought weekly Stochastic, Natural gas can be expected to fall to the next support level 3.815.