– Natural gas reversed from the support area

– Likely to rise to the resistance level 3.67

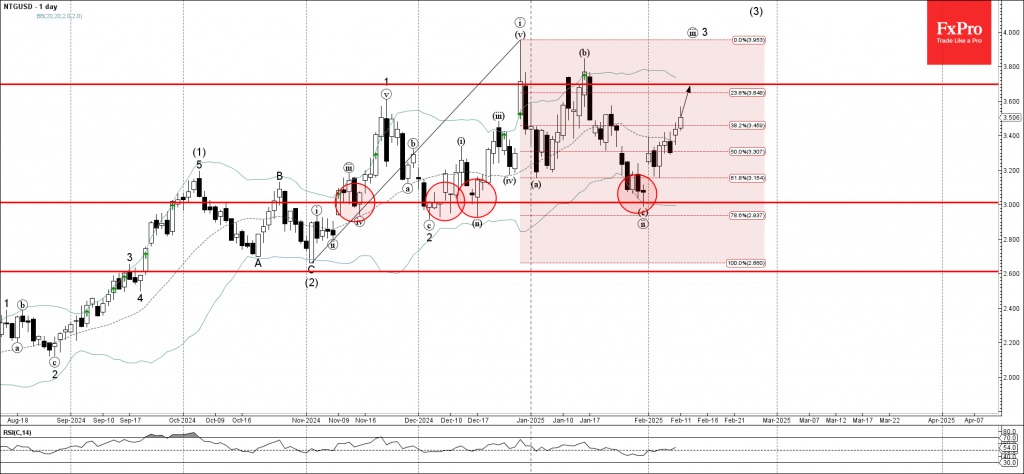

Natural gas continues to rise strongly inside the short-term upward impulse wave iii, which started earlier from the support area located between the round support level 3.0000 (which has been steadily reversing the price from November) and the lower daily Bollinger Band.

The upward reversal from this support area created the daily upward gap – which signals the strength of this support area.

Given the clear daily uptrend, Natural gas can be expected to rise to the next resistance level 3.67 (which has been reversing the price from December).