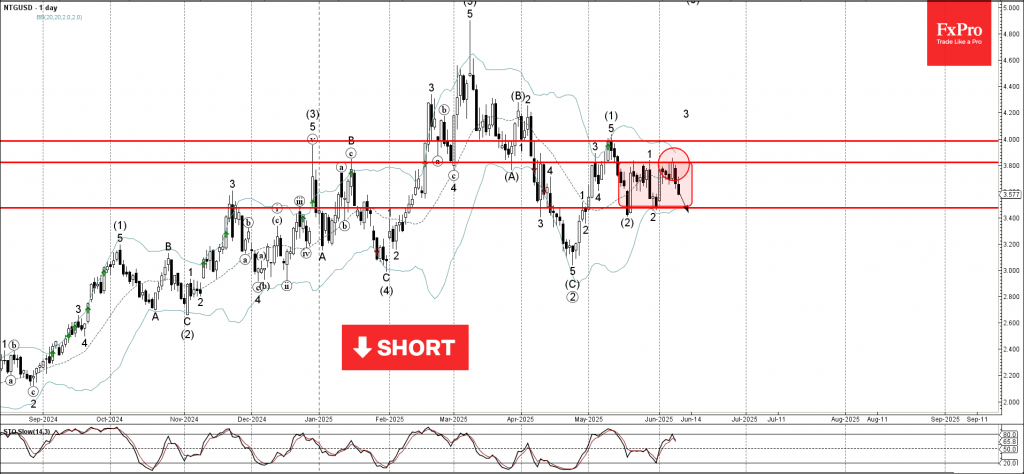

Natural Gas: ⬇️ Sell

– Natural Gas reversed from key resistance level 3.80

– Likely to fall to support level 3.50

Natural Gas recently reversed down from the pivotal resistance level 3.80 (which is the upper border of the narrow sideways price range inside which the price has been trading from May).

The downward reversal from the resistance level 3.80 created the daily Japanese candlesticks reversal pattern Bearish Engulfing.

Given the strong daily downtrend, Natural Gas can be expected to fall to the next support level 3.50 (lower border of the active price range, low of waves (2) and 2).