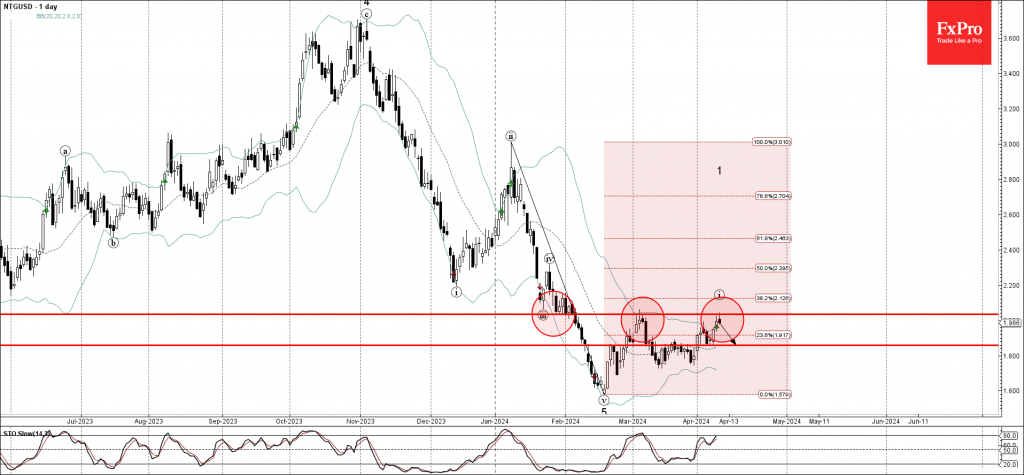

– Natural gas reversed from key resistance level 2.035

– Likely to fall to support level 1.860

Natural gas recently reversed down from the key resistance level 2.035 (former strong support from the end of January and the monthly high from March).

The downward reversal from the resistance level 2.035 stopped the previous minor impulse wave i.

Given the strength of the resistance level 2.035, prevailing downtrend and the overbought daily Stochastic, Natural gas can be expected to fall further to the next support level 1.860 (low of the morning star from the start of this month).