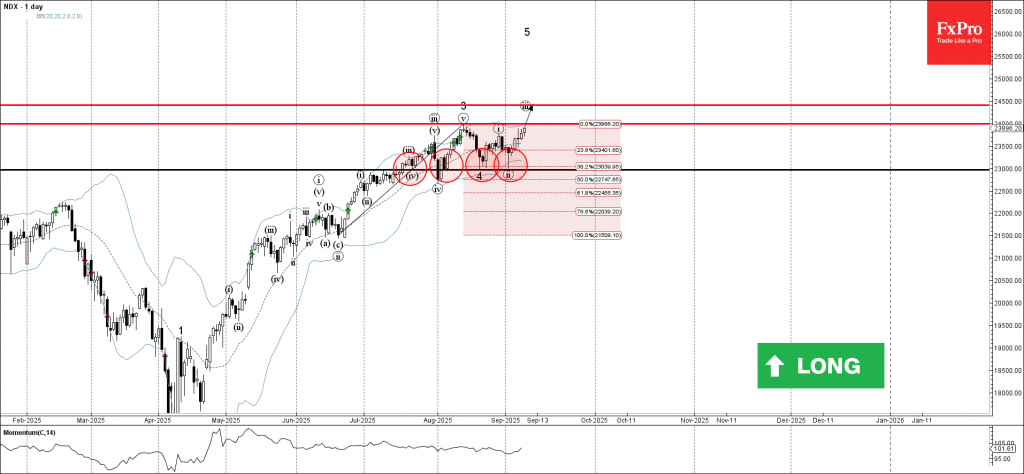

Nasdaq-100: ⬆️ Buy

– Nasdaq-100 reversed from the support area

– Likely to rise to resistance level 24500.00

Nasdaq-100 index recently reversed up from the support area between the pivotal support level 23000.00 (which has been reversing the price from July), lower daily Bollinger Band and the 38.2% Fibonacci correction of the upward impulse from June.

The upward reversal from this support zone created the daily Japanese candlesticks reversal pattern Hammer – which started the active impulse wave iii.

Given the clear daily uptrend, Nasdaq-100 index can be expected to rise toward the next resistance level 24000.00 (top of wave 3), the breakout of which can lead to further gains toward 24500.00.