– Nasdaq-100 reversed from pivotal support level 20800.00

– Likely to rise to resistance level 21800.00

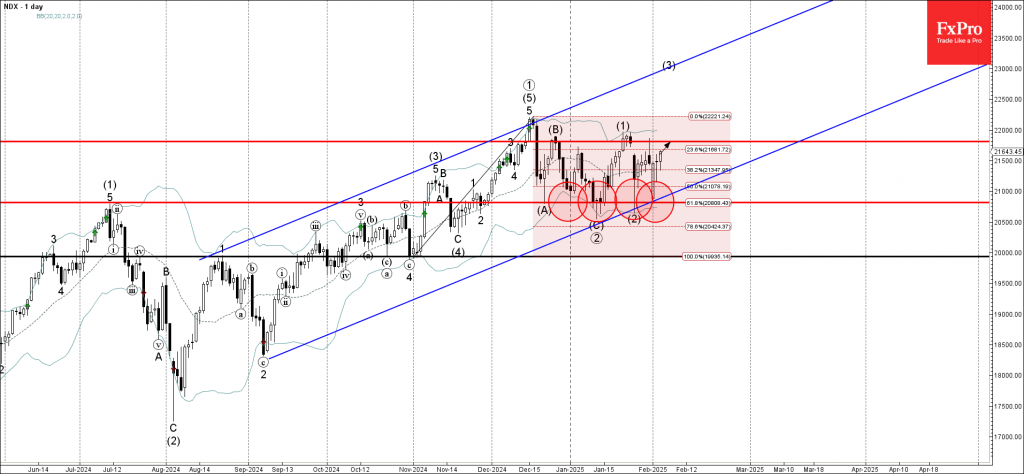

Nasdaq-100 index previously reversed up from strongly the pivotal support level 20800.00, which has been steadily reversing the price from the end of December.

The support level 20800.00 was further strengthened by the lower daily Bollinger Band, support trendline of the daily up channel from September and the 61.8% Fibonacci correction of the upward impulse from October.

Given the clear daily uptrend, Nasdaq-100 index can be expected to rise to the next resistance level 21800.00 (top of the previous waves B and 1).