– Nasdaq 100 reversed from strong support level 21000.00

– Likely to rise to resistance level 22000.00

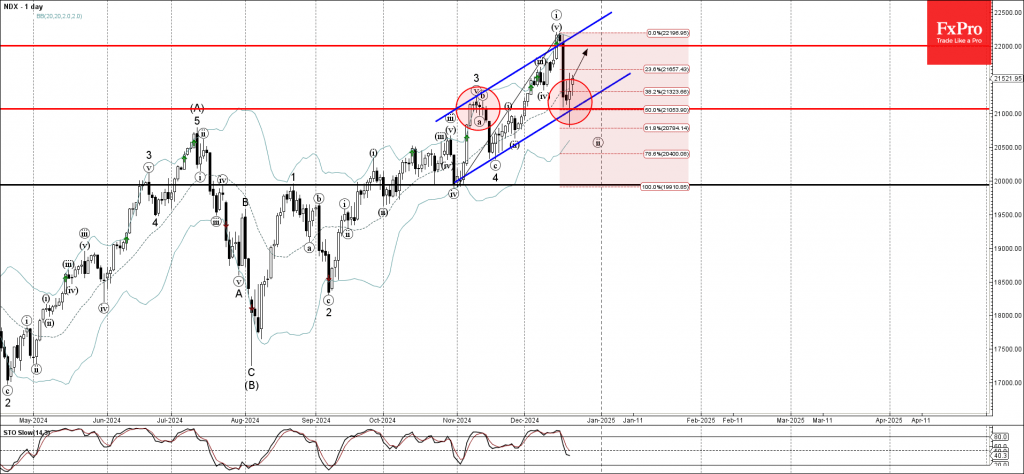

Nasdaq 100 index recently reversed up from the strong support level 21000.00 (former resistance from the start of November), intersecting with the support trendline of the daily up channel from November and the 50% Fibonacci correction of the upward impulse from October.

The upward reversal from the support level 21000.00 created the daily Japanese candlesticks reversal pattern Long-legged Doji.

Given the clear daily uptrend, Nasdaq 100 index can be expected to rise to the next resistance level 22000.00, which stopped the previous impulse wave i.