– Nasdaq-100 broke daily down channel

– Likely to rise to resistance level 21850.00

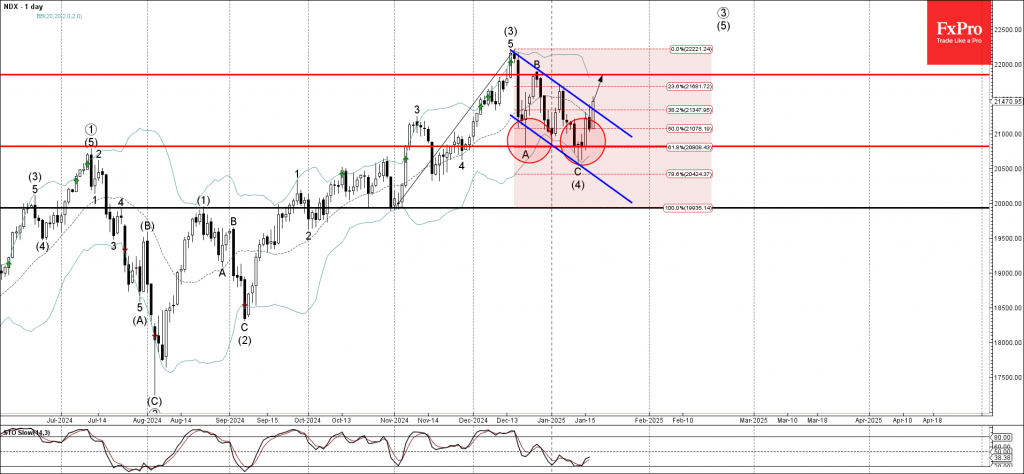

Nasdaq-100 index rising inside the intermediate impulse wave (5), which started earlier from the support zone located between the key support level 20820.00 (former low of wave A from December) and the support trendline of the daily down channel from December (which encloses earlier ABC wave (4)).

The index just broke the aforementioned down channel which should accelerate the active impulse wave (5).

Given the strong daily uptrend, Nasdaq-100 index can be expected to rise to the next resistance level 21850.00, top of the previous B-wave.