– Nasdaq-100 index reversed from support zone

– Likely to rise to resistance level 19500.00

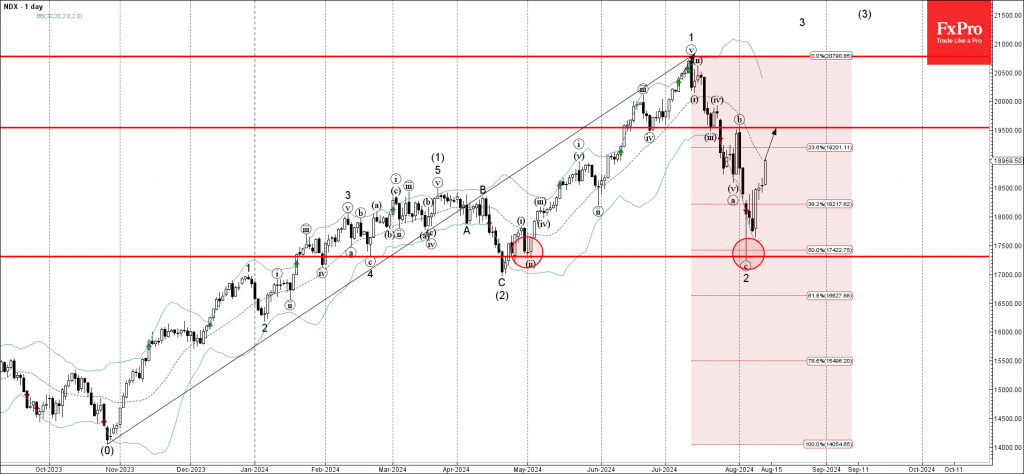

Nasdaq-100 index continues to rise inside the minor impulse wave 3, which started recently from the major support area set between the long-term support level 17300.00 (which has been reversing the index from February) and the 50% Fibonacci correction of the sharp upward impulse from last October.

The upward reversal from this support area is aligned with the intermediate impulse wave (3) from the end of April.

Given the clear daily uptrend, Nasdaq-100 index can be expected to rise further toward the next resistance level 19500.00 (which stopped the previous correction (b) in July).