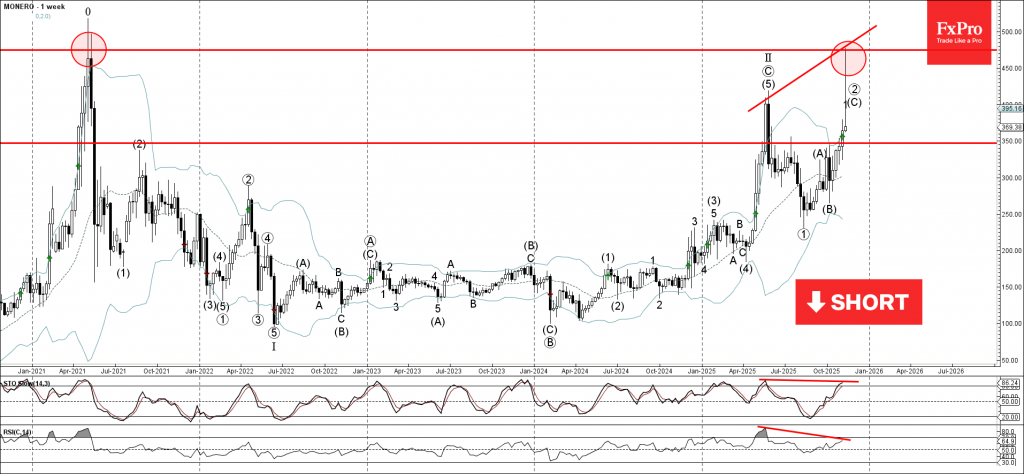

Monero: ⬇️ Sell

– Monero reversed from resistance area

– Likely to fall to support level 350.00

Monero cryptocurrency recently reversed down sharply from the major resistance area between the long-term resistance level 475.00 (which stopped the sharp weekly uptrend in 2021) and the upper weekly Bollinger band.

The downward reversal from this resistance area is currently forming the long weekly candlesticks reversal pattern Shooting Star – strong sell signal for Monero.

Given the strength of the resistance level 475.00 and the bearish divergence on the weekly Stochastic and RSI indicators, Monero cryptocurrency can be expected to fall to the next support level 350.00.