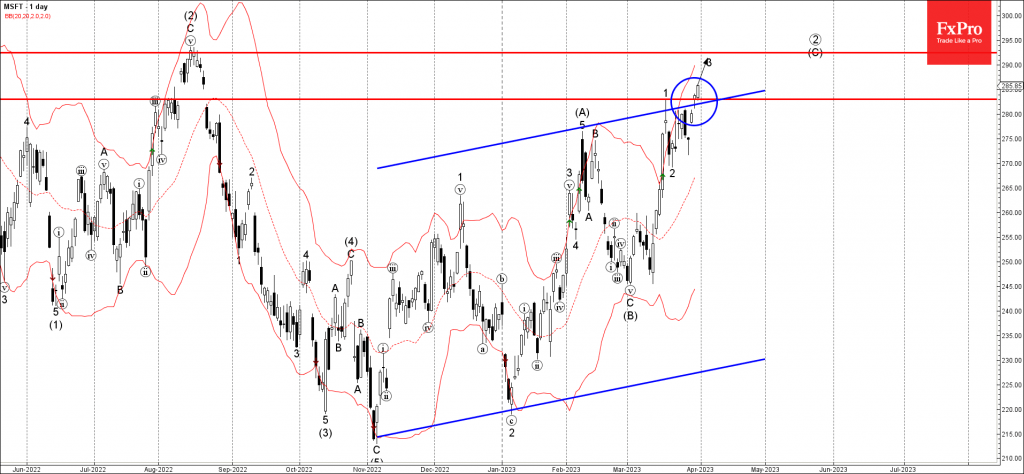

• Microsoft under the bullish pressure

• Likely to rise to resistance level 292.50

Microsoft under the bullish pressure after the pair broke above the key resistance level 283.00 (top of the previous long-legged Doji from the middle of March)

The breakout of the resistance level 283.00 coincided with the breakout of the resistance trendline of the wide up channel from November.

Microsoft can then be expected to rise further in the active accelerated impulse wave 3 toward the next resistance level 292.50 (former multi-month high from August).